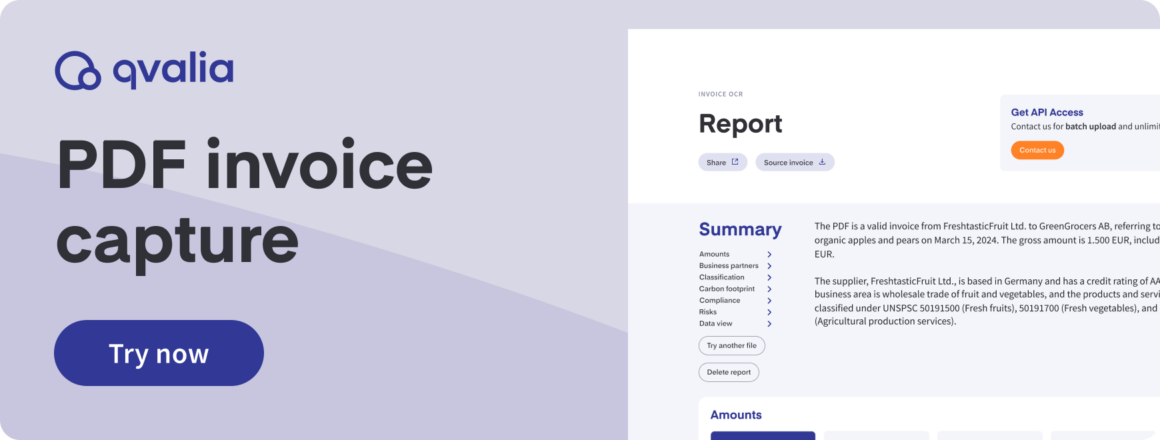

We’re introducing PDF invoice capture — a powerful PDF-to-XML tool that digitizes, transforms, analyses, and enriches PDF invoices at no cost.

Traditional OCR scanning services often fall short when it comes to invoice processing. They extract only selected information and sums while ignoring the full invoice context, sometimes requiring strict formats and templates, leading to a high risk of errors and lost information.

The result? Businesses are left with fragmented data, often containing errors or low-quality information, leading to time-consuming manual handling and the need for multiple tools to properly digitize, process, and analyze invoices.

Our new tool makes digitizing PDF invoices for one-off needs easy and fast, completely free of charge. It is a simplified version of our solution designed to streamline our customers’ processes and provide complete control over all transactional data.

PDF-to-XML data extraction

PDF invoice capture immediately captures the invoice data and converts it into a structured XML set with at least 99.5% accuracy.

The tool uses advanced AI-driven OCR (Optical Character Recognition) technology trained exclusively on transactional data. It captures all relevant invoice details, including line items, tax information, and company details, ensuring nothing gets lost. The extracted data is structured and mapped into an XML format, making it easy to process in any ERP, accounting, or procurement system.

Once the invoice is in XML format, it can be transformed into any format. It is made available as Peppol BIS Billing but can be transformed into formats such as UBL, EDIFACT, JSON, or CSV, enabling automated invoice processing across different platforms and regulatory frameworks.

Compliance report with AI-driven insights

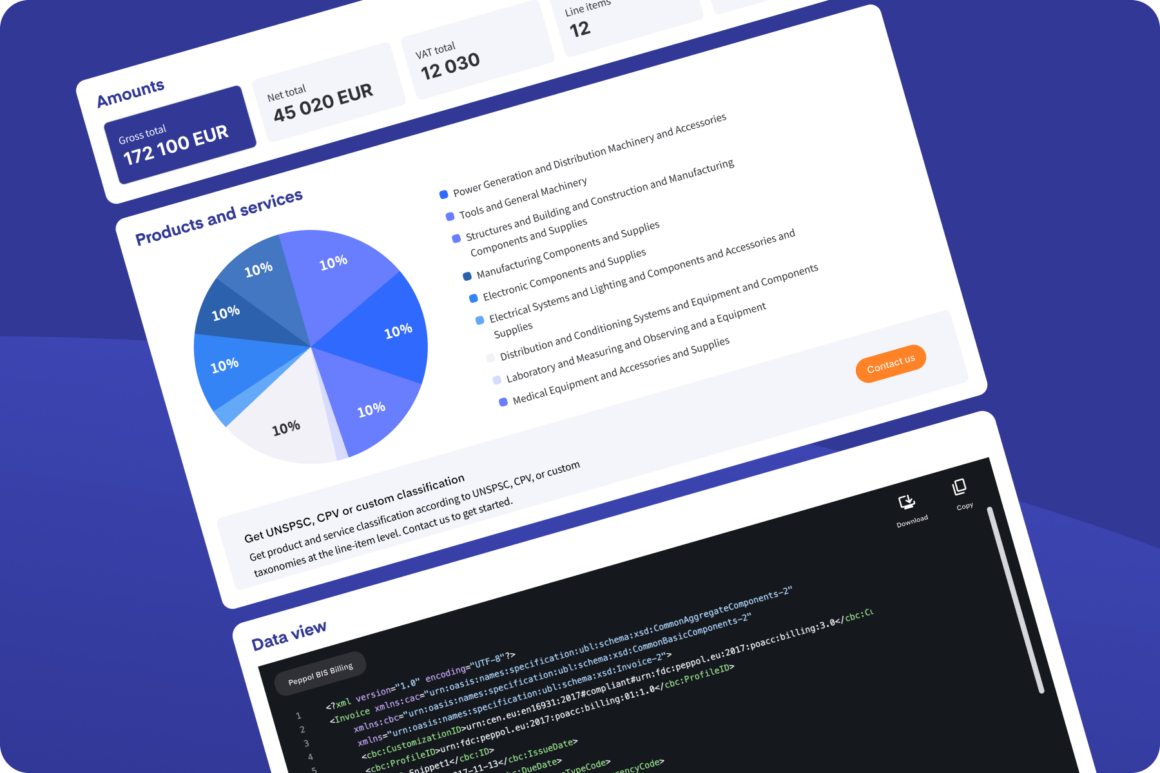

In addition to transforming invoices into structured XML, PDF invoice capture provides an AI-powered report with critical risk assessment and spend analysis insights. The report showcases our capabilities to enrich our users’ transactional data and provide deeper insights, from controlling and compliance to detailed analytics in real-time by providing:

- Invoice summary & key data extraction: Get a clear overview of extracted values, including amounts, VAT details, and payment terms.

- Company lookup & credit rating: Instantly verify sender and receiver details with an automated search in global company databases, including business information and credit risk assessments.

- Compliance check: Ensure invoices meet local and international tax regulations and reduce non-compliance risk. The invoice is also validated if it aligns with e-invoicing standards for the Peppol network.

- Line-item classification: Products and services are automatically categorized using the UNSPSC (United Nations Standard Products and Services Code), improving spend analysis.

- Financial risk assessment: Identify risks and detect anomalies, for example, missing VAT details, incorrect invoice formats, or incomplete transaction information, that could cause processing errors or compliance risks.

How it works

- Visit the PDF invoice capture.

- Upload a PDF invoice.

- Await processing.

- Receive a structured XML file and review the insights report.

- Download & use the data for processing, compliance, and analysis.