Let’s face it: Automation and integration are the goals of any business today. They’re how companies will keep up with competitors as technology evolves and digital transformations become the norm.

And for many businesses, adapting to these rapidly evolving trends usually starts with the finance department.

2019 Zion Market Research predicted the global e-invoicing market would reach US$20.529 billion by 2026, with an estimated CAGR of 20.4%. Considering estimates like these that came before the global pandemic started, it’s clear that e-invoicing and digital finance are here to stay.

It’s also important that companies understand what makes e-invoicing not just a nice-to-have but a must-have solution for modernizing their finance process.

We’ve put together this guide to show you how invoices have evolved through the rise of EDI to the more modern e-invoicing solutions you see today.

The e-invoicing difference explained

Electronic invoicing, or e-invoicing, is the distribution of invoices between suppliers and buyers in a fully integrated digital and structured format, making transactions safer and significantly easier to process.

This electronic form of billing simplifies sending, receiving, and filing invoices, decreases transaction costs, and increases business financial processing efficiency with automation.

E-invoices contain the same information as traditional formats. However, the primary distinction is that data is structured as digits and characters in fixed and machine-readable fields. This automated component eliminates traditional distribution risks of manual handling and processing and can improve account receivable processes.

From custom EDI invoicing to simplified e-invoicing: addressing the initial growing pains

Moving towards a more integrated and automated purchase invoice and billing processing system just makes sense. For many big businesses and institutions, switching to e-invoicing is the digital solution they can employ to keep up with the increasing flow of invoices. It’s the ideal solution for tackling economies of scale as your business grows.

However, the transition wasn’t always seamless. E-invoicing is a byproduct of early EDI systems and the limitations they faced.

Traditional Electronic Data Exchange (EDI) systems were relied on to handle data exchange between businesses, vendors, and other aspects of the finance process. However, these systems were bulky, required configuration with complex implementations, and required custom-built systems. It was a structural nightmare for many smaller businesses trying to adopt EDI’s default technical standards to enable exchanging electronic data between two parties.

Luckily, the introduction of e-invoicing was the modern solution businesses worldwide could transition to. From the hard-coded EDI hotlines and binary exchanges, second-generation e-invoicing utilized the broad internet infrastructure and VAN services (Value Added Services) to offer a wider solution.

It offered the same enterprise-grade functionality EDI offered without the intensive technical configurations required to make it all work.

VAN services: second-generation e-invoicing in traditional closed EDI networks

VAN services are the operators that eliminate the rigidity of EDI through a simplified electronic “post box” system for invoicing. These operators ensure that e-invoices are sent and received by the right parties.

Second-generation e-invoicing was far more efficient than traditional EDI hard-coded structural processes. However, as there currently is limited unification or full global standardization of e-invoicing among operators, minor configurations still have to be made to enable cross-operator distribution.

Existing in a closed network also meant some barriers in scalability and issues with distribution charges. Businesses and institutions had to consider the various e-invoice standards on the global and national scale. Luckily, the later evolution of e-invoicing would only push this format further.

Third-generation e-invoicing: the investment worth making

The global adoption of more cloud and standardized technologies has made simple international interoperability more commonplace. Users want simplicity and ease in their digital user experience, and third-generation e-invoicing offers that.

With more unified electronic formats, these invoicing distribution processes have become increasingly seamless and intuitive.

The most adopted and fastest-growing format globally is the Pan-European Public Procurement On-Line (Peppol). This format has been used all across the European Union since 2019, and

has seen more international adoption for its ease of use and cost efficiency, including in Canada, Australia, New Zealand, and Singapore.

Peppol: more than just simplifying e-invoicing and EDI

The biggest advantage of Peppol is its use of open network structures that eliminate the need for interoperability of independent and local e-invoice operators.

Using a Peppol Participant Identifier (Peppol ID), the address for e-invoices and other e-documents, users can exchange e-invoices and files rapidly and intuitively. Click here to search the global database for Peppol IDs.

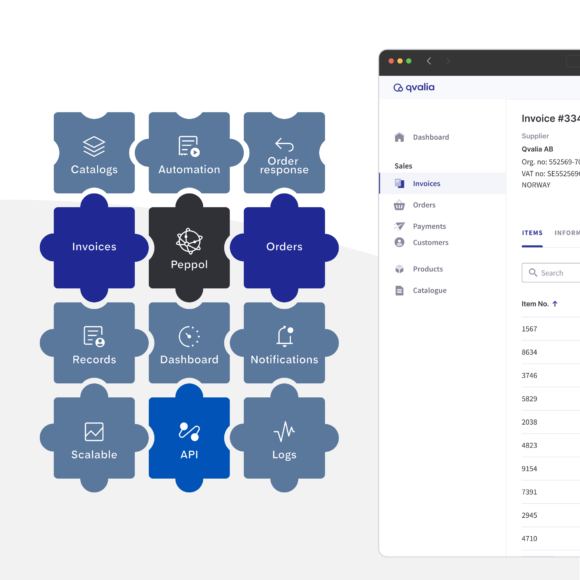

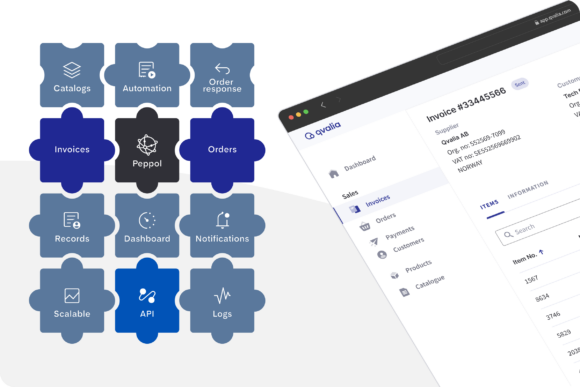

Companies only need access to a Peppol-certified access point and integrate it into their invoice management software or ERP to seamlessly process communication and distribution of e-invoices. You can get started swiftly using our Peppol access point service.

This third-generation e-invoicing can potentially transform business processes, big and small. The integrated and straightforward approach has been advantageous for local e-invoice operators who rely heavily on fees to generate revenues within their closed networks.

Simplified EDI access: send and receive e-invoices

Setting up your e-invoice inbox address and signing up with an EU-certified Peppol access point are the first steps to transforming your e-invoice finance process. At Qvalia, we provide Peppol e-invoicing for free.

Sending involves four easy steps: input, conversion, portal, and transfer. Software providers like Qvalia typically handle distribution, conversions, and delivery, so you have fewer things to worry about.

Receiving and accounts payable is the more complicated part. Human error and manual issues can often increase the risk of incorrect payment or mismanaged finances. E-invoicing and EDI ensure essential information needed for this step is entered correctly and efficiently through a simple three-step receiving process: entry, preparation, and processing. You typically need to ensure your ERP can read the structured format. Most operators or software providers can help you with that part.

Check out our latest ebook for more in-depth information on sending and receiving e-invoices.

Ready to get started with e-invoicing? Qvalia can help

Upgrade your finance process with modern e-invoicing. With Qvalia, you can transform your business processes with our automated invoice handling, deviation handling, and accounting and analytics on a line-item level.

Talk to us or visit our website to sign up for free and get started.