Artificial intelligence for business documents

Process transactional business documents such as invoices, orders, and catalogs in a consolidated data format. Enhance your precision in automation and analytics. Improve compliance and reduce the organizational workload.

Discover our services for intelligent document processing, from data extraction and processing to analytics.

Unified management of invoice data

PDF data capture

AI instantly converts PDF invoices into structured XML, capturing all content.

Electronic invoice management

E-invoices are seamlessly received and processed. Support for Peppol BIS Billing and standard EDI formats, such as EDIFACT.

Content and compliance validation

Invoice content is validated for compliance, quality, and your requirements, ensuring enhanced data control.

Optimal accuracy

Transaction-specialized LLM with over 99% accuracy.

Trained on your data

Customized to your workflow.

Full support

Full support from onboarding and beyond.

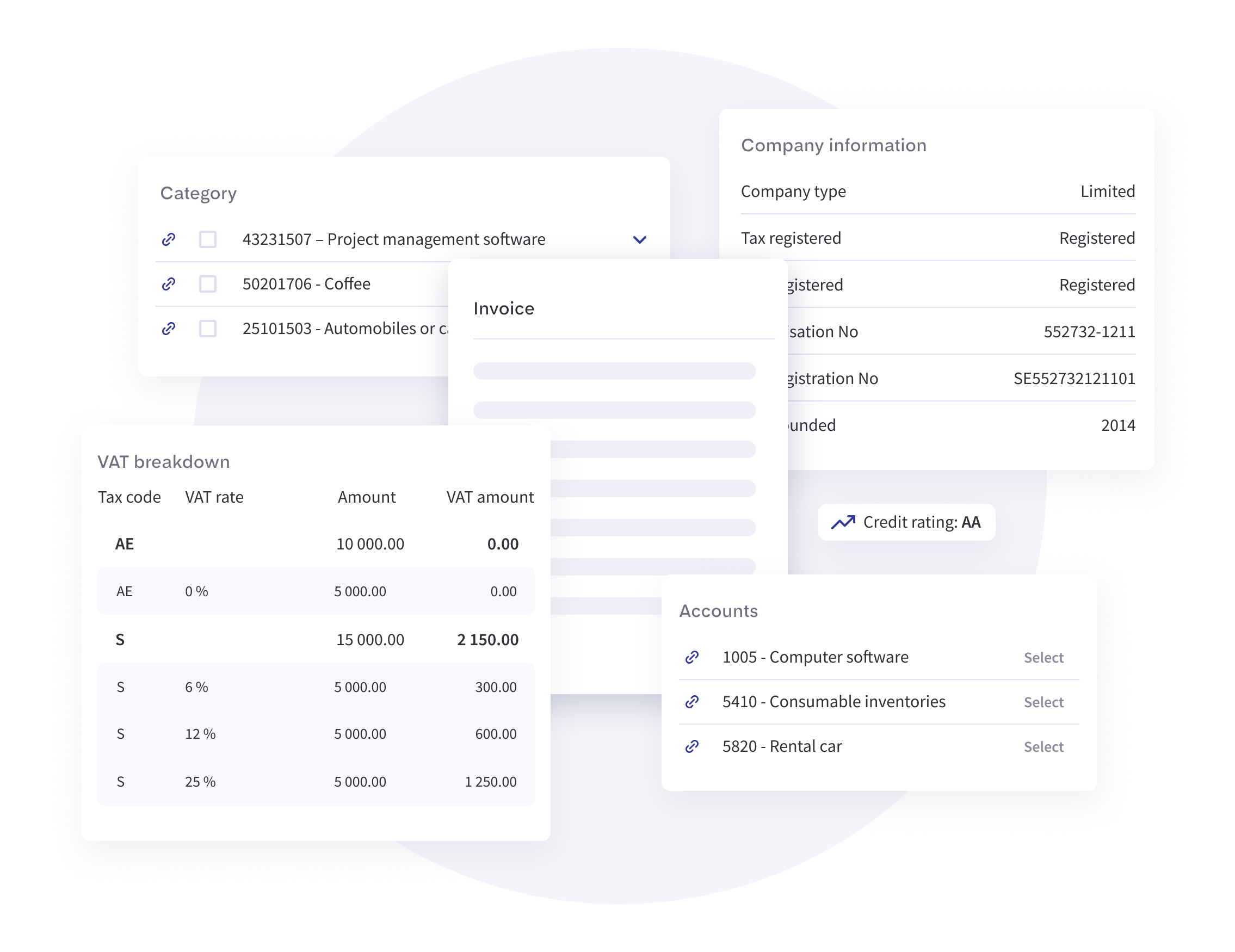

Accounting automation with AI posting

Automated invoice posting automates your accounting process and reduces organizational workload.

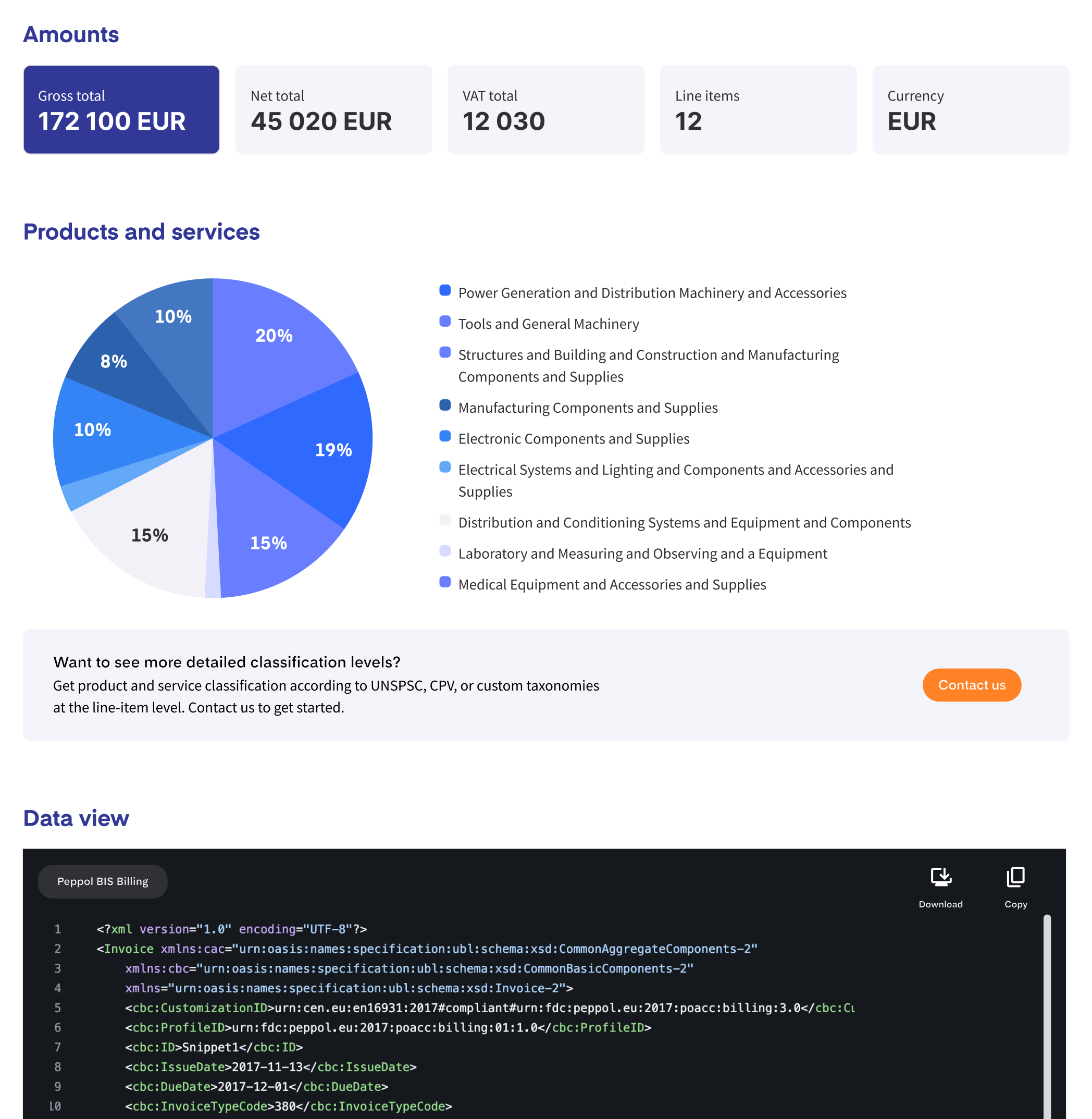

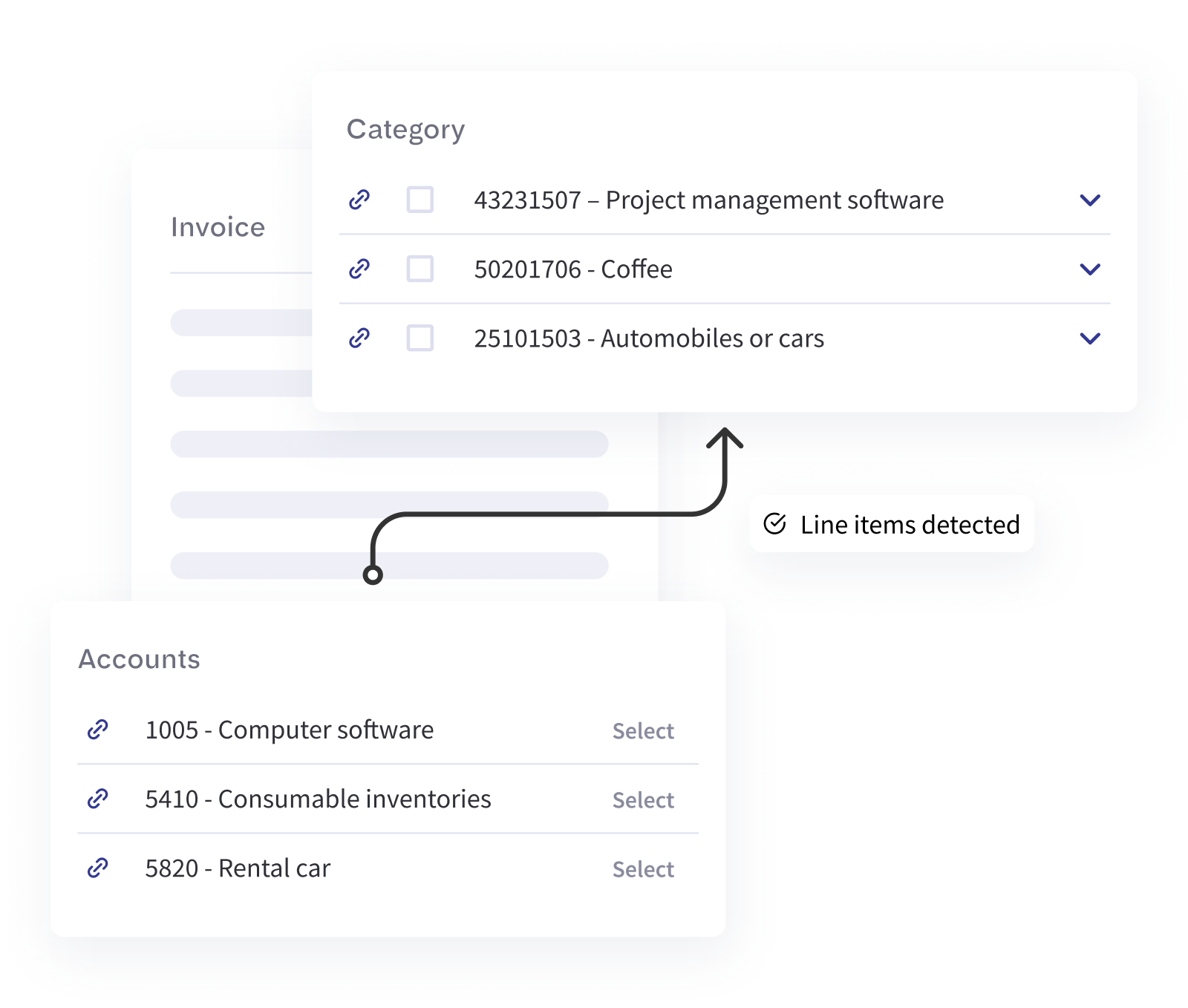

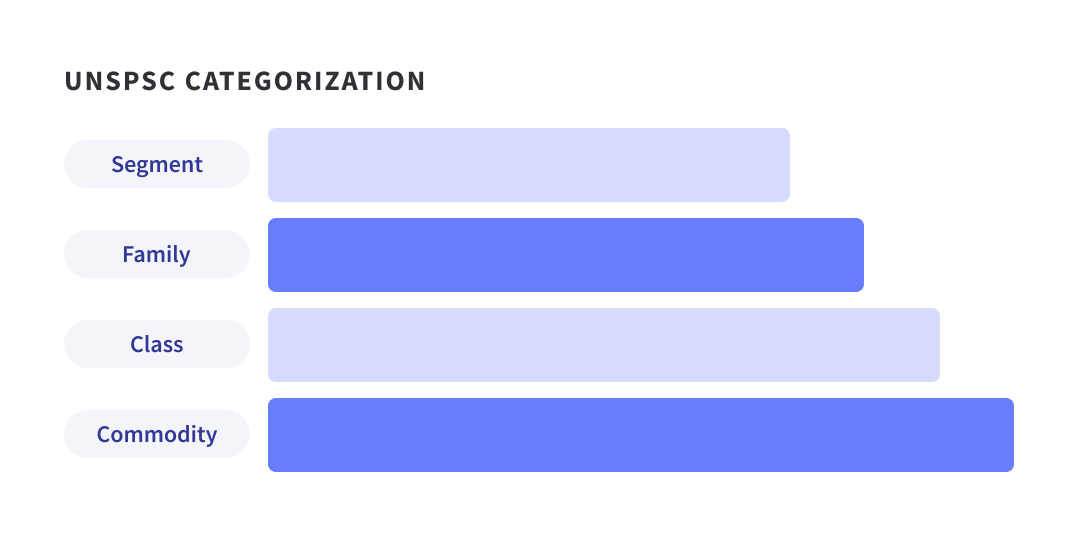

Instant product & service classification

AI categorizes products and services according to UNSPSC, CPV, or custom classification, improving your control and analytics capabilities.

Data extraction

AI extracts key invoice data from PDFs and outputs it as JSON or Peppol XML. Choose your extraction level.

Header-level

information

- Invoice number

- Invoice date

- Due date

- Total amount

- VAT amount

- Currency

- Payment reference

- Payment information

- Supplier details

- Customer details

- Invoice type

Line-item level

information

- Product number

- Product/service name

- Description

- Quantity

- Unit price

- Line total

- Tax per item

- Tax rate

- Unit code

Upload & try

Upload an invoice to our demo tool and see how your data is extracted and transformed in seconds.

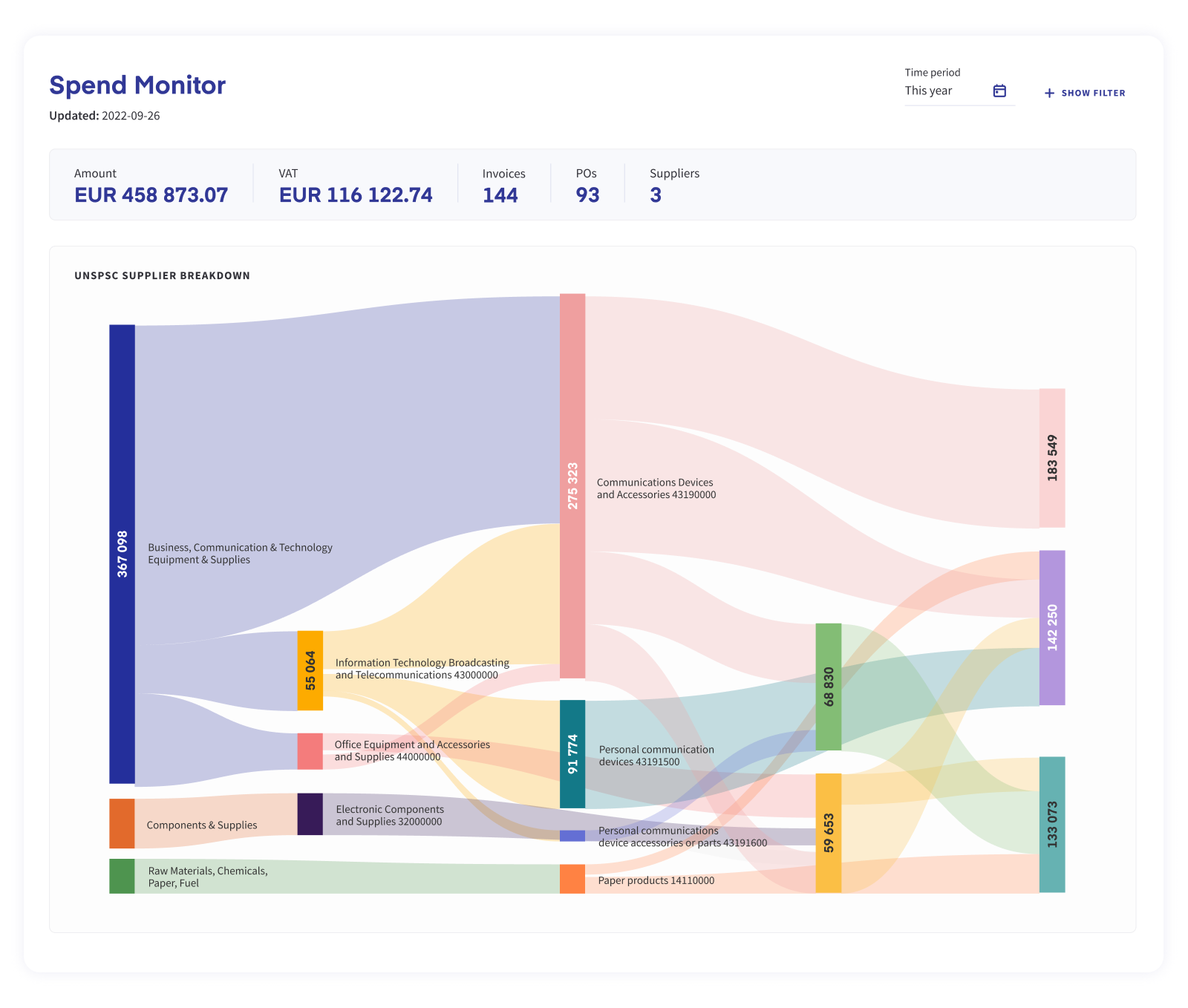

Analytics with precision

Structured data management enables instant access to detailed spend analysis. Consolidated data capture, automated validation, and classification enable complete visibility into organizational spending.

Intelligent document processing — integrated

Simplified integration to your ERP — Intelligent document processing services are provided via documented developer-friendly APIs and SFTP file transfer.

Get in touch

Manage, automate, and visualize your sales and purchase transactions with Qvalia. Our customers achieve full control over transactional data, enhance automation, and get deeper insights.

Improve processing with AI-driven enrichment at the line-item level. Get connected efficiently via API.

Contact us to see how we can optimize your processes.

Create, send & receive electronic business documents efficiently

Create, send & receive electronic business documents efficiently

AI-powered data enrichment

AI-powered data enrichment

Digitize and streamline your processes

Digitize and streamline your processes

What is Intelligent Document Processing (IDP)?

Intelligent Document Processing (IDP) is a technology that automatically reads, extracts, and structures information from documents such as invoices, receipts, forms, and PDFs. It combines OCR, machine learning, and rule-based validation to convert unstructured or semi-structured content into clean, reliable data that can be used directly in accounting, procurement, and automation workflows. By reducing manual data entry and improving accuracy, IDP streamlines document-heavy processes and enables fully digital, automated operations.

Which fields are extracted from my PDF invoice?

PDF Capture extracts the key information needed to automate, validate, or convert invoices into structured formats like JSON or Peppol XML. Both header-level data and detailed line-item data are supported.

Header level extraction

Invoice number

The unique identifier assigned by the supplier to the invoice.

Invoice date

The date the invoice was issued.

Due date

The deadline for payment.

Total amount

The full payable amount including taxes and charges.

VAT amount

The total value-added tax applied to the invoice.

Currency

The currency used on the invoice (e.g., SEK, EUR, USD).

Payment reference

A reference used for matching incoming payments (such as OCR or reference number).

Payment information

Bank details required to complete the payment, such as Bankgiro, Plusgiro, IBAN, BIC, and account numbers.

Supplier details

Registered information about the supplier (organisation number, VAT number, name).

Customer details

Registered information about the buyer or recipient of the invoice.

Invoice type (invoice or credit note)

Identifies if the document is a standard invoice or a credit note.

Line-item extraction

Product number

Identifier for the product or service, often item code or SKU.

Product/service name

The name or label of the product or service being invoiced.

Description

Additional description or details about the item.

Quantity

How many units were delivered or invoiced.

Unit price

The price per unit before taxes or discounts.

Line total

The total amount for the line item (quantity × unit price).

Tax per item

The tax amount calculated for the line item.

Tax rate

The percentage of tax applied to the line item.

Unit code

The unit of measure used (e.g., PCS, HRS, KG).

How does Intelligent Document Processing support my business process?

Intelligent Document Processing enhances business operations by automating data extraction, categorization, and analysis from invoices, contracts, and other documents.

This reduces manual work, minimizes errors, and speeds up workflows, enabling your team to focus on higher-value tasks. By classifying and organizing information — such as line items, spending categories, and supplier details — AI helps create a structured, accessible data flow across your systems. The result is real-time insights, faster workflow, improved compliance, and a streamlined process from data capture to final reporting, ultimately saving time and costs.

How does IDP integrate with my existing systems?

Our IDP solution is designed to seamlessly integrate with various ERP and accounting systems and data management systems via API connections.

With flexible integration options and comprehensive documentation, you can easily connect the AI to your existing workflows, enabling automated data flow without disrupting your setup.

What types of documents can the AI process, and in which formats?

The AI can process multiple business documents, including invoices, receipts, purchase orders, contracts, price lists, and more.

Supported formats include PDF, XML, XLS, and even image files, making it adaptable to the document types and file structures commonly used in your business.

How secure is the data processed through the AI system?

Data security is a top priority. Our AI processing system is protected by SSL encryption and meets industry data privacy and compliance standards.

Read more about security, trust, and performance at Qvalia.

How quickly can I expect results from AI-driven IDP?

The AI provides real-time or near-real-time processing, depending on your workflow needs. Results are typically available instantly for documents uploaded individually, while batch processing for large volumes can be completed quickly, ensuring you have access to structured data when needed.