B2B payments are an essential part of the business world. Companies must pay vendors for supplies, subscriptions, and other common expenses.

While it’s true that B2B payments are similar in some ways to traditional forms of payment, there are key differences that you should be aware of.

First, you must understand that B2B transactions are not as simple as B2C because a purchase between organizations can involve a wide variety of payment methods, payment schedules, and other factors.

Read on to learn more about how B2B payments evolve, the different types of B2B payments and how they impact your organization.

The B2B payment methods

The exact payment methods used in B2B transactions depend on what the companies prefer, but the following are some general types.

Cash #1

Cash is fairly uncommon nowadays, whether we’re talking about B2B or B2C. It’s not always convenient to have all that cash on hand at one time, and you have to be physically located near your supplier for the transaction to go through. Cash also has some problems with security if you’re sending it through the mail. Don’t expect it to be a factor in today’s market.

Check #2

Just like cash, paper checks have the usual inconvenience and risks of cash. Similarly, processing checks is error-prone and time-consuming. A good chunk of B2B payments today are actually made with checks, but the method is slowly losing traction in favor of digital options.

Credit card #3

Credit cards have several advantages that most of us already know about. They are modern, convenient, and fast. They are secure and are automatically tracked. They even allow deferring payments to billing cycles for easier budgeting. However, some of the drawbacks include processing costs, risk of fraud, and additional paperwork required for working with credit card statements.

Wire transfer #4

Wire transfers have one of the fastest processing times of any B2B payment method, as the funds can generally be used by the receiving party within 24 hours. Wire transfers can be costly to complete, but they are ideal for international payments.

Automated clearing house #5

ACH occurs when money is directly transferred from one bank account to another. Because of the amount of paperwork involved, you aren’t likely to see it used for one-time purchases, but it shines in repeat payments. That is, it’s relatively fast and comes with low fees. Keep in mind though that it’s only available in the United States and can be difficult to reverse if you ever make a mistake. There’s also the privacy concern since you have to share your bank account information for it to happen.

Virtual cards #6

Credit cards and ACH are already some examples of electronic payments, but another that’s gaining attention in the B2B space is the virtual card. It’s generally free of fees, fast to use, and secure. Expect to see it in the near future for business transactions.

Traditional payment gateways #7

Some service providers act as the middleman between the sender and recipient of the money. The gateway vendor collects the money and deposits it securely at the destination. A well-known example you might know of is Stripe. Payment gateways can be used in either one-time transactions or recurring ones, though be mindful that you are relying on the expertise of the gateway vendor when you’re using one.

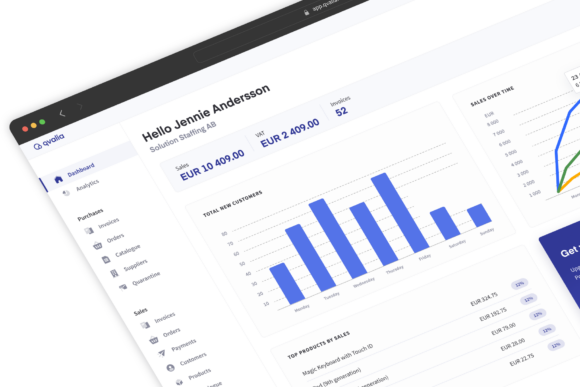

B2B payment gateways #8

Payment solutions optimized for business customers with capabilities to send invoices in various formats upon checkout, goes by the name of B2B payment gateways. Authentication of customers can be managed via integrated workflow apps or mandatory accounts and secure log-ins.

This wide variety of payment types only shows how much more complicated a single B2B transaction can be compared to a B2C one. This pattern is one of many that show why the O2C process focuses so much on the intricacies of B2B purchases.

Are B2B payment patterns changing?

One trend to take note of is that more traditional payment methods like cash are giving way to modernized, digital ones. This pattern is largely due to major changes in the market and new risks that businesses today must address.

For instance, COVID-19 has reduced the usage of physical payment methods for obvious reasons. There’s also a rising amount of financial crime happening with older payment methods. And finally, more and more of us are expecting a faster, more efficient payment experience.

The result is that electronic B2B payments are greatly taking over as part of the digital transformations most companies are going through. Going electronic means you have prioritized payment security, more flexibility in how you can conduct a transaction, and a means to record all financial activity for future audits.

Want to know how you can start automating many of the menial tasks involved in B2B payment processing and what you can do to simplify the process for your financial staff? Learn more about order-to-cash in our new guide.