Transactions, technologies and trends

Category: Order-to-cash

Order-to-cash (O2C)

Order-to-cash, often abbreviated as O2C or OTC, is a fundamental business process encompassing the entire workflow from receiving a customer’s order to collecting payment for the goods or services. It integrates multiple departments, including sales, order management, invoicing, and accounts receivable, ensuring a seamless and efficient sales cycle. The primary goal of the O2C process is to optimize revenue generation, enhance customer satisfaction, and maintain accurate financial records.

The O2C process typically includes the following steps:

- Order Entry: The process begins with a customer placing an order. This order is recorded and documented to initiate the subsequent steps.

- Order Processing: Orders are validated internally through inventory checks, pricing verification, and credit approval to ensure feasibility and compliance with agreed terms.

- Invoicing: After order validation, an invoice is generated detailing products or services, quantities, pricing, and applicable discounts. E-invoicing is often used to expedite this process.

- Delivery: Depending on the nature of the goods or services, products or services are delivered to the customer either physically or digitally.

- Payment: Customers make payments based on the invoice terms. Payment methods may include bank transfers, credit cards, checks, or other prearranged methods.

- Accounts Receivable Management: This involves tracking outstanding payments, following up on overdue invoices, and initiating collection actions if necessary.

- Reconciliation: Payments are matched with corresponding invoices, and any discrepancies are resolved to maintain accurate financial records.

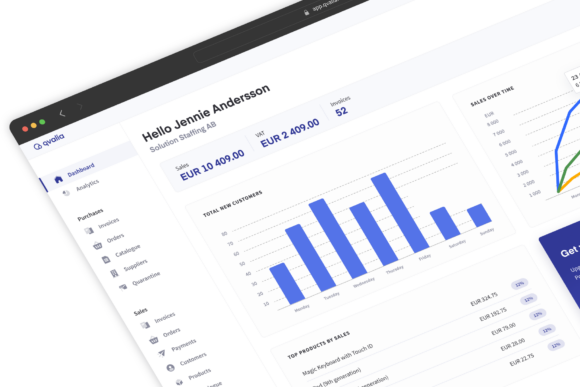

- Reporting and Analysis: Data from the O2C process is analyzed to monitor cash flow, identify revenue trends, and understand customer payment behaviors.

- Customer Relationship Management: A well-executed O2C process improves customer experiences by ensuring timely deliveries, accurate invoices, and efficient payment handling.

An optimized O2C process enhances operational efficiency, reduces errors, accelerates cash flow, and strengthens customer relationships. As businesses adopt digital transformation, the O2C process increasingly leverages technologies like automation, integrated software platforms, and data analytics to improve accuracy and efficiency further.

Learn more about the digital transformation of the order-to-cash process in our related articles.

Integrated Digital Trade (IDT) refers to the seamless exchange of goods, services, and information between companies through digital platforms and technologies.

How can you level up your order-to-cash processes with data management and business messaging? Join this webinar on new technology in O2C.

Today’s businesses must frequently monitor all aspects of the order-to-cash process to ensure that everything is running correctly and efficiently. Experienced management teams look for several standard metrics in this regard.

A successful B2B e-commerce merchant heavily depends on the provided experience. The service catering to the needs of business customers is crucial; level of …

Are you familiar with factoring and order financing? Factoring is the practice of buying up unpaid invoices at a discounted price so that the …