The Peppol network has evolved into the international standard for secure, structured, and interoperable electronic business transactions. As of November 2025, 46 countries and territories are members of OpenPeppol, the non-profit organization governing the Peppol network. Here’s the complete Peppol country guide.

Global B2B interoperability — now a reality

From Europe to Asia-Pacific, North America, and Africa, the network continues to expand, enabling businesses and public sectors to exchange e-invoices, e-orders, and other business documents across borders through a single, trusted digital infrastructure.

Peppol provides a standardized method for exchanging business messages, including e-invoices, e-orders, and credit notes. Every participant connects through certified service providers — known as Access Points — and identifies themselves with a Peppol ID.

This setup eliminates the need for custom integrations or bilateral connections. Whether your counterpart is a public authority in Finland or a supplier in Singapore, Peppol ensures that your business documents arrive securely and in the correct format.

Discover the key differences between Peppol and traditional B2B message exchanges (VAN).

Peppol country availability

Peppol now includes:

- All EU member states plus the UK, Norway, Switzerland, and Iceland

- Major global economies such as the US, Canada, Japan, China, India, and Australia

- Growing participation across Asia (Singapore, Malaysia, Taiwan), the Middle East (UAE), and Africa (South Africa, Nigeria)

Countries participate in the Peppol network at different levels — some operate as national authorities, others host certified service providers, while a few are connected through pilot or associate memberships.

- Peppol Authority & Certified providers

Countries that manage a national Peppol Authority and host certified service providers enabling full network governance and access. - Certified providers

Countries with certified Peppol service providers but without a national Peppol Authority. - Other

Countries or territories connected through other membership types or pilot participation in the Peppol network.

This expansion marks Peppol’s transition from a European e-invoicing initiative to a global interoperability framework.

Peppol country guide

Australia

Peppol is the official standard for e‑invoicing across both public and private sectors, with 129 government entities and 410,000 businesses registered. The government invests heavily in adoption and is considering future mandates to accelerate uptake.

Austria

Austria mandates Peppol for B2G transactions, boosting interoperability and e-procurement nationwide. The country has strong infrastructure and public sector compliance.

Belgium

Belgium requires all suppliers to the public sector to send e-invoices via Mercurius, integrated with Peppol. Upcoming regulations will require B2B e-invoicing by January 1, 2026.

Canada

Peppol was introduced in 2019, but diverse regulations and low awareness have hampered its adoption. Access points operate, but there is no national mandate yet.

China

China participates in Peppol primarily through certified access points in pilot programs. Adoption focuses on international business rather than nationwide mandates.

Croatia

Croatia uses Peppol for public sector e-invoicing and is piloting digital procurement reforms. E-invoicing is part of its efforts to integrate with the EU.

Cyprus

Cyprus is an OpenPeppol member with public entities using Peppol for B2G e-invoicing. National legislation promotes the wider adoption of public procurement.

Czech Republic

The Czech Republic facilitates cross-border e-invoicing through Peppol, adhering to EU standards. Private sector adoption is growing alongside public mandates.

Denmark

Denmark was the first country to require e-invoicing for public procurement, using Peppol via NemHandel since 2005. All government suppliers must comply, making Denmark a global pioneer.

Estonia

All Estonian public sector workflows utilize Peppol for e-invoicing, in accordance with EU directives. The private sector is increasingly interconnected for digital trade.

Finland

Finland requires all suppliers to public sector entities to send e-invoices that comply with the European Standard. Since April 2024, government procurement contracts have been mandated to use Peppol Advanced Ordering for electronic purchase orders and responses. The Finnish State Treasury acts as the national Peppol Authority, and these measures are advancing digital B2G trade, making Peppol a cornerstone of public procurement workflows in Finland.

France

France utilizes the central Chorus Pro platform, which supports Peppol for B2G and B2B transactions.

France officially designated its tax authority (DGFiP) as the national Peppol Authority in July 2025, ahead of its major B2B e-invoicing mandate scheduled for September 2026. The government is actively developing technical standards, launching the PPF Directory for invoice routing, and requiring businesses to use certified platforms with Peppol connectivity; public sector Peppol use is well established, and B2B adoption is entering its pilot phase, with full mandatory issuance and e-reporting for large businesses beginning in 2026 and SMEs following in 2027.

Germany

Germany requires public entities to accept e-invoices via Peppol, though suppliers can choose formats. National platforms like XRechnung integrate Peppol for interoperability.

Greece

Greece’s government portal supports Peppol with one central access point for e-invoicing. E-procurement reform is ongoing to expand adoption nationwide.

Hungary

Hungary is an OpenPeppol member, actively developing its e-invoicing frameworks. Full-scale B2G deployment is in progress.

Iceland

Iceland mandates Peppol e-invoicing in the public sector, leveraging its advanced digital infrastructure. The private sector is encouraged to adopt the network for cross-border trade.

India

India introduced Peppol as a common exchange network for SMEs and the government in 2020, with a focus on healthcare and commerce. Alignment with national GSTN systems remains a challenge.

Ireland

Ireland’s public procurement office uses Peppol for mandatory B2G e-invoicing. Significant progress has been made in bridging public and private sector platforms.

Italy

Italy mandates electronic invoicing through the SdI platform, which supports Peppol for B2G and B2B exchanges. Peppol ensures compliance, security, and tax transparency.

Japan

Japan began Peppol adoption with pilot projects and now requires Peppol for electronic transactions between large enterprises and public entities. National adoption is gradually increasing.

Jordan

Jordan pilots Peppol for government-to-business e-invoicing, aiming to standardize procurement. Expansion into wider commerce is planned.

Lithuania

Lithuania’s public entities use Peppol, with steadily growing adoption in e-invoicing and procurement reforms. National law supports further digitization using OpenPeppol.

Luxembourg

Luxembourg requires Peppol in B2G, using various access points for public entities. The Ministry for Digitalisation spearheads implementation.

Malaysia

As of July 2025, all Malaysian taxpayers are required to comply with e-invoicing mandates, utilizing Peppol for interoperability. Early adoption focused on large businesses, with full rollout underway.

Malta

Malta leverages Peppol for public sector e-invoicing as part of digital government reforms. B2B enablement is being expanded.

Mexico

Mexico’s e-invoicing is in pilot stages, with Peppol used mainly for international business. National mandates are not yet in place.

Netherlands

Peppol is required for public sector e-invoicing in the Netherlands, supporting EU-wide trade. Simplerinvoicing, an initiative based on Peppol, streamlines transactions.

New Zeeland

Over 50,000 NZ businesses are registered for e-invoicing via Peppol, with public sector mandates active. Government suppliers will be required to use Peppol, as Government agencies with more than 2,000 domestic invoices per year must be e-invoice capable by January 1, 2026; large suppliers by January 1, 2027.

Nigeria

Nigeria runs Peppol pilots for digital government transactions, exploring broader implementation. Full-scale adoption is still developing.

Norway

Norway is a Peppol founding member and mandates Peppol for all public sector transactions. The government actively expands Peppol to orders and other domains.

Poland

Poland requires Peppol for B2G e-invoicing, alongside national platforms to ensure compliance. The country will expand B2B e-invoicing mandates by February 2026 for large taxpayers and by April 1 for all others, with a sanction-free period during 2026.

Portugal

Portugal mandates Peppol for government procurement, integrating it with the eSPap platform. B2B expansion plans are in progress.

Romania

Romania is gradually implementing Peppol for public sector e-invoicing. Ongoing reforms focus on enhancing interoperability and facilitating trade.

Serbia

Serbia uses Peppol for pilot digital documents and e-invoicing reforms. Expansion is planned as digitalization accelerates.

Singapore

Peppol adoption is led by the InvoiceNow system, gradually expanding mandates for GST businesses. Singapore is a regional trailblazer with phased rollouts through 2026.

Slovakia

Slovakia’s public sector uses Peppol for e-invoicing and procurement, in line with EU directives. Private sector take-up is growing.

Slovenia

Public sector entities in Slovenia transmit invoices via Peppol in accordance with national law. The country continues to upgrade e-invoicing standards.

South Africa

South Africa is piloting Peppol in the public sector, with a focus on interoperability with EU trade partners. Further mandates are under discussion.

Spain

Spain utilizes Peppol for B2G e-invoicing compliance and will require B2B transactions to use e-invoicing during a phased rollout, starting in the second half of 2026. Systems integrate Peppol for streamlined reporting.

Sweden

Sweden requires Peppol for all public sector e-invoicing, relying on the SFTI platform for compliance. National mandate in place since 2019. Widespread access points support business and government.

Switzerland

Switzerland is an OpenPeppol member; pilots for public sector Peppol adoption are underway. Full implementation remains in progress.

Taiwan

Taiwan is piloting Peppol for e-invoicing, with a focus on international B2B exchange. National reforms are under consideration.

Turkey

Peppol pilots in Turkey aim to facilitate digital trade between the private sector and the government. Widespread adoption is still forthcoming.

UAE

The UAE has started Peppol adoption within the government, aiming to standardize e-invoicing for future expansion. Broader implementation efforts are ongoing.

UK

The UK utilizes Peppol for NHS transactions and public sector e-invoicing, with cross-border trade being well supported. B2B adoption is expanding post-Brexit.

USA

Peppol is widely used in pilots and private sector initiatives, but it lacks a federal mandate. Adoption is growing among businesses seeking global interoperability.

The Digital Business Networks Alliance (DBNA) is the U.S. e-invoicing association, modeled after Europe’s Peppol network. Both use a similar 4-corner model and open, standardized technical specifications to allow businesses to exchange electronic documents.

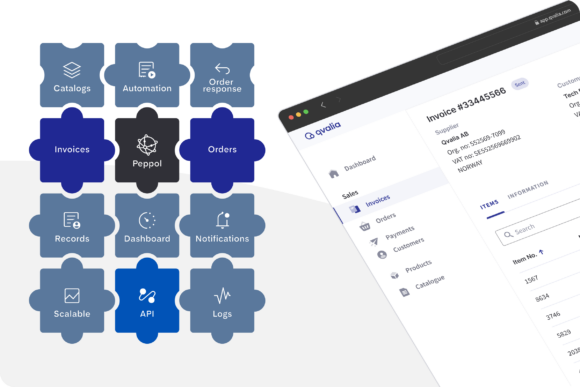

Get connected: Peppol services with Qvalia

As a certified Peppol Access Point, Qvalia enables companies of all sizes to send and receive Peppol-compliant documents instantly.

Through Qvalia Connect, users can join the network immediately.

- Register a Peppol ID in minutes

- Receive and manage e-invoices, e-orders, and more

- Achieve full Peppol compliance without technical complexity

- Integrate via API or use Qvalia’s web interface

- Start for free, upgrade as you scale

Our platform supports the latest Peppol BIS standards, providing visibility, control, and automation across the entire transaction flow.

Outlook

With nearly 50 countries now on board, Peppol is becoming the backbone of digitalization in global trade. Governments and enterprises alike recognize its potential to reduce costs, increase transparency, and unlock automation. At Qvalia, we continue to support this growth by helping organizations connect, comply, and innovate on B2B transactions.

For further reading on compliance, e-invoicing, and Peppol, download the latest report from trusted experts Billentis or learn more by signing up for Peppol Academy.