KPIs, key performance indicators, are nothing new. They are used and closely tracked by most companies and serve as a direct measure of performance in critical areas of the business. They are often one of the foundations of the decision-making process. In finance, order-to-cash KPIs can provide invaluable insights into your cash flow and customers, as well as your internal efficiency.

Today’s businesses must frequently monitor all aspects of the order-to-cash process to ensure that everything is running correctly and efficiently. Experienced management teams look for several standard metrics in this regard.

We’ve compiled a quick list detailing what we believe you should be tracking regarding order-to-cash KPIs.

Essential order-to-cash KPIs

You should notice that some of these metrics are specific to the accounts receivable department, though some can be useful for the financial management team in general.

Revenue contribution #1

How much is the order-to-cash process contributing to the business’s total revenue? The higher this figure is, the more you earn from selling products as opposed to other sources of income. Most management teams would obviously prefer to maximize this value, and it typically takes the form of a percentage of total revenue.

Average days delinquent #2

Average Days Delinquent (ADD) focuses on your collection performance by considering a receivable’s due date and paid date. ADD gives you a solid ballpark metric without requiring extensive data collection and analysis. The information provided is straightforward, unlikely to contain errors, and relatively easy to generate.

Collections effectiveness index #3

Maintaining control over company cash is about boosting efficiency in collections and cutting down on any gaps or inefficiencies in the process. The collections effectiveness index (CEI) helps you determine how well you secure overdue payments.

The metric considers the portion of collected payments that make up the total available receivables. CEI should ideally be above 80%, and any numeric below that figure is a sign of poor performance somewhere in the order-to-cash policy.

You can collect CEI over any specified period. Choosing a shorter time allows you to generate more specific insights into process gaps and helps you identify them as they occur.

DSO — Days sales outstanding #4

Also known as DSO, the day’s sales outstanding metric shows how long the business takes to receive the payment after a sale. Cash flow can be challenging to keep track of, and managers running the company on credit must know this figure to keep debt in check and track earnings accurately.

Employee full-time equivalent #5

Full-time equivalent (FTE) is a measure of an employee’s workload. It matters for order-to-cash KPIs because you want to know the individual productivity of each staff member related to sales. If the workload is too high for the number of employees on-site, then you have an indicator to assign more staff to that task. Likewise, you might want to drop some people if there are too many.

Measuring FTE is a way to optimize your costs now and help plan for the future when you must decide on how many employees you need for a later project.

Reporting frequency #6

We’ve mentioned before that reporting and analytics matter in the order-to-cash process, whether we’re looking at the supply chain, the inventory management, the manufacturing, or the logistics.

Regular reports give you an up-to-date picture of how smoothly everything is running and allow you to track key performance indicators directly related to order-to-cash.

Bonus: Automation

Tying into the last point, it’s clear that order-to-cash relies heavily on data entry, analytics, and at worst, paperwork. These three tasks are much faster and more reliable on automated software-based solutions than traditional manual sales and accounts receivable processes.

Increasing the level of automation allows you to speed up your throughput, minimize delays, and lower the risk of error. By adopting digital formats, such as e-invoices, e-orders, and e-catalogs, we’ll secure that your analytics is always based on correct data. It also often results in better analytics and reporting capabilities.

One of the most potent trends in order-to-cash is punchout technology. It allows buyers and sellers a dynamic way for sales, A/R, and procurement to seamlessly connect and do business, based on correct pricing with a high level of process automation. The technology greatly improves, for example, the capabilities of B2B e-commerce.

Start tracking with Qvalia today

Order-to-cash is an essential process to optimize, with dozens of key performance indicators and metrics to track and analyze.

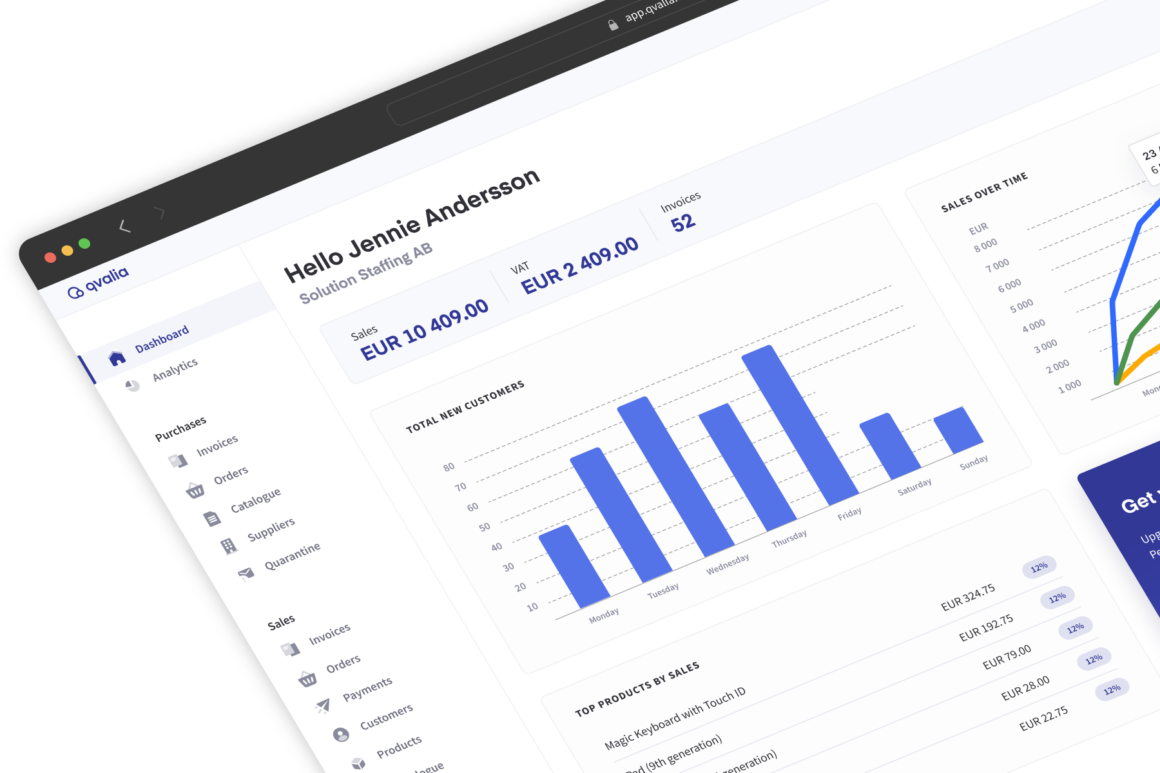

Our B2B payment and automated invoicing solution offer real-time order-to-cash KPIs, full accounts receivable visibility and valuable customer insights, credit ratings and more.

Are you ready to put the right KPIs to work for your business? Book a demo with our team.