Whether we’re talking about physical sales or e-commerce, business transactions can all be categorized into two major types: business-to-business (B2B) and business-to-consumer (B2C).

How you approach the order-to-cash process relies heavily on which type you’re dealing with, so let’s go over the distinction between B2B and B2C and how they impact O2C.

What is B2B?

Business-to-business refers to the relationship between two companies, for example when a company provides products, services, or both to another company in exchange for money. The customer involved is always another legal entity, organization, company, governmental organization, or NGO.

This is the case for business-to-business (B2B) payments — for example:

- A company subscribing to an app from an internet startup.

- A hospital ordering professional training services from a third-party provider.

- A laptop manufacturer purchasing components like displays or CPUs.

B2B may involve merchants, vendors, wholesalers, or other types of businesses and can come in the form of one-time purchases or recurring subscriptions. Either way, any time one company invoices another, we are talking about B2B transactions, which involve the order-to-cash process.

What about B2C?

In a business-to-consumer transaction, an individual consumer rather than an organization is the end-user who receives the products and services by the company. If you’ve ever purchased a product on Amazon, eaten at a restaurant, or done some shopping at a brick-and-mortar store, you’ve been involved in a B2C transaction.

B2C is getting even more popular with the advent of online shopping. Nowadays, we’re seeing B2C sales made on both manufacturer websites and on intermediary sites like Etsy and Trivago. Social media communities like Facebook likewise have their own marketing and advertising features for B2C sales.

One of the most recent developments in online B2C is fee-based payments. Take Netflix or paid newspapers for example. These services charge a regular fee to provide a continuous service.

How does this distinction impact order-to-cash in B2B?

Order-to-cash is a subset of your overall sales process. When a customer places an order, you perform these actions in order to deliver the goods or services and receive the payment.

A common mistake online retailers make is treating business clients as if they were individual customers. Companies make up a large part of the consumer base and have unique needs that should be addressed in O2C. B2B and B2C transactions differ in several ways:

- Scale: B2C often deals with large-scale marketing since you’re working with a large number of potential customers. B2B deals with more niche markets by comparison.

- Purchasing options: Sales and discounts notwithstanding, most B2C transactions occur on a single pricing tier, whereas B2B payments are more varied. You might have a basic package for smaller businesses and a professional one for larger enterprises.

- Client-facing interface: The website for a B2B transaction usually looks like an account dashboard intended to inform so that clients can quickly compare options and make decisions. The website for a B2C transaction is mainly made to look attractive and persuasive to push the conversion.

- Persuasion: When you’re selling to regular customers, you typically want your marketing to be emotionally driven to persuade people to buy. By contrast, a B2B salesperson would want to use logical reasoning instead since other businesses are more empirical and data-driven when it comes to making purchasing decisions.

- Checkout intricacies: To encourage B2C conversions, you want to make the checkout process as simple and pain-free as possible. Any additional steps can result in abandoned carts, the bane of today’s e-commerce teams. B2B checkouts might include all those extra steps to accommodate the added complexity of business-to-business transactions.

B2B typically involves larger cash amounts and may be, but not always, more logistically complex compared to B2C. The result is a generally longer, slower process as more verifications and decisions must be made throughout.

Understanding the differences between business-to-business and business-to-consumer transactions is key to perfecting the order-to-cash process. Thanks to the rise of the “as a Service” economy, B2B transactions are likely to increase greatly in the coming years, and the B2B market will likely take up a larger portion of your O2C activity.

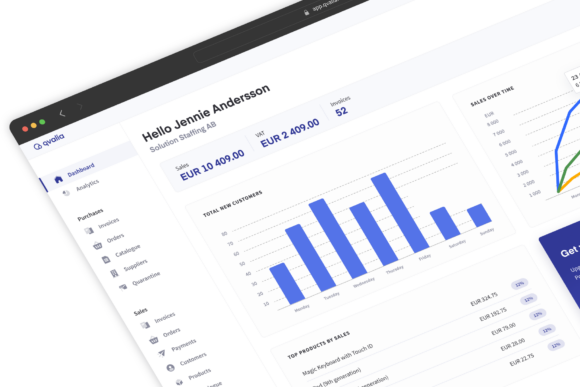

Start automating order-to-cash with Qvalia

The order-to-cash process your business goes through to fulfill an order depends greatly on whether the end-user will be a customer or another business. That is, how you advertise, sell, and process order changes depending on who the recipient is. B2B vs. B2C is a distinction every financial department or CFO must know.

Handling B2B transactions takes a lot of manual work, invoice processing, and data entry. The best way to turn orders into revenue faster is through an automated order-to-cash solution.

Interested in learning more about how order-to-cash? Get our free guide.