Companies constantly seek ways to streamline their operations and enhance productivity in today’s fast-paced business landscape. One crucial aspect of any business is managing finances and transactions, particularly involving labor-intensive invoices. Traditional manual invoice processing is a time-consuming and error-prone process. However, invoice automation has emerged as a must-have technology.

In this blog post, we will explore the concept of invoice automation, its benefits, its implementation process, and its potential to transform business efficiency.

Understanding invoice automation

Invoice automation is the process of using software solutions to automate various stages of invoice processing. These stages may include invoice creation, submission, approval, payment, and reconciliation. The primary goal of invoice automation is to reduce manual tasks, improve accuracy, enhance control and visibility, and ultimately expedite the invoice-to-payment process.

How invoice automation works

Supplier invoice invoice reception

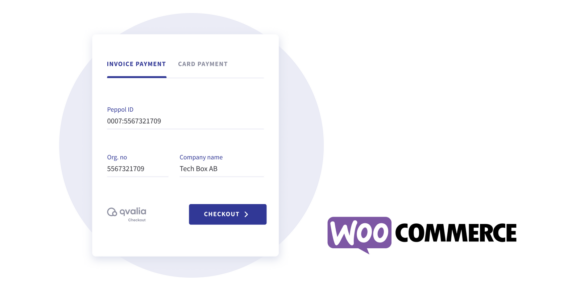

Invoice automation begins with securing transactional data in a structured format. Electronic invoices (e-invoices) in a standardized format, such as Peppol, are ideal message types: lossless, instantly exchanged, and completely machine-readable.

The adoption of e-invoices is growing continuously, but PDF image files are still the dominant format. It is cheap and easy to use but highly insufficient for qualitative invoice automation. The method for data extraction of PDF invoices is optical character recognition (OCR), which scans and interprets invoice data, converting it into machine-readable formats.

Workflow automation

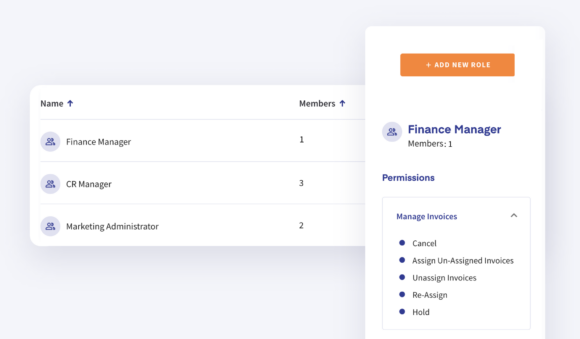

Once the data is extracted, the invoice automation system routes the invoice through a workflow. This workflow is customized according to the organization’s specific requirements and may include various invoice approval and validation levels.

Approval and deviation handling handling

The system automatically routes invoices to designated approvers based on predefined rules. In case of any invoice discrepancies or exceptions, the system can flag them for further review and resolution.

Integration with accounting systems

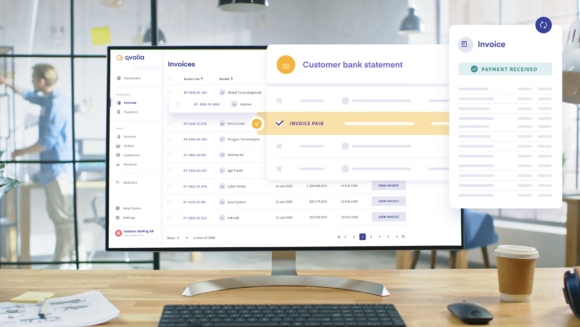

Once the invoice is approved, the automation system integrates seamlessly with the organization’s accounting software or ERP. This integration ensures that the approved data is transferred accurately and efficiently, minimizing the risk of human error.

Six benefits of invoice automation

- Time and cost savings: Manual invoice processing is time-consuming and can strain financial resources. Invoice automation significantly reduces the time and effort required for processing, enabling employees to focus on more strategic tasks.

- Improved accuracy: Human errors in data entry are common in manual invoice processing. Invoice automation reduces the risk of mistakes, ensuring accurate data entry and reducing the chances of costly errors.

- Faster approvals: With automated workflows, invoices move swiftly through the approval process, reducing bottlenecks and delays. This, in turn, improves vendor relationships and fosters a more efficient supply chain.

- Enhanced visibility, analytics, and control: Invoice automation provides real-time visibility into the entire invoice-to-payment process and gain valuable insights into organizational spend. Businesses can track invoices, identify potential issues, and make data-driven decisions to optimize cash flow management.

- Better compliance and audit trail: Automated systems maintain a detailed audit trail of invoice processing activities, making it easier to comply with regulatory requirements and undergo audits.

- Streamlined vendor management: The automation system can help businesses maintain a centralized database of vendors, facilitating better communication and fostering stronger supplier relationships.

Implementing invoice automation

- Assessing business needs: Before implementing an invoice automation solution, businesses must evaluate their unique requirements, budget constraints, and existing processes.

- Choosing the right solution: Various invoice automation software options are available in the market. Businesses must select a solution that aligns with their defined needs, integrates well with their existing systems, and offers scalability for future growth and efficient analytics for managers. Receiving e-invoices requires connecting to a so-called access point to a business network and registering a unique identifier, such as Peppol ID or GLN.

- Employee training: Introducing any new system requires proper training for employees. Ensuring that all relevant stakeholders understand the new process is essential for a seamless transition.

- Testing and integration: Before full deployment, testing of the invoice automation system is crucial to identify and resolve any potential issues. Many service providers can also offer web-based interfaces without the need for extensive integration.

Invoice automation is a transformative technology for any financial process, empowering businesses to optimize workflows, reduce operational costs, and drive greater efficiency.

By eliminating manual data entry, expediting approvals, and improving accuracy, businesses can focus on strategic initiatives and cultivate stronger relationships with vendors and partners. Embracing invoice automation streamlines operations and positions businesses to adapt and thrive in an increasingly competitive market. As this technology evolves, more organizations will embrace its advantages, propelling the business world into a future of heightened productivity and enhanced financial management.

For more inspiration on invoice automation and how to digitize invoice management, download our guide: Next generation e-invoicing — from basics to proficiency.