Financial process automation is increasingly becoming a priority for CFOs.

With worldwide spending on digital transformation — the intermix of digitization, new processes, and user experiences in businesses and the public sector — reaching $1.78 trillion by 2022, it’s no secret that organizations everywhere are looking for ways to implement the latest technologies to streamline operations, make customers happy, and improve bottom-line results.

Automation is probably the most apparent outcome, ranging from the reduction of manual work — from low-skilled tasks to more complex operations — to the provision of precise business intelligence in vast amounts of data.

If you’re in the middle of adopting automation into your workflow, where should you start?

We believe that finance is one of the most fruitful fields to begin your digital transformation and financial process automation journey, as there are many opportunities to free up time for staff members, ensure fast and error-free completion of critical tasks across the organization, and enable smart utilization of your transactional data, costs and revenue streams alike.

The next big thing in finance

Modernizing financial activities began with digitization, one of the first steps in a digital transformation. Even as these tasks changed over time, finance departments were able to make their workflows more manageable and efficient thanks to digitization. For instance, digitization made the analysis of data easier and helped teams with actionable insights faster.

Going beyond digitization was automation, the capabilities to actually transform processes. Finance is filled with repetitive tasks, long workflows, and precise data that must not be tarnished by human error. Automation gets these parts of the job off the plates of your human staff, giving them a chance to work on more interesting or creative aspects of the company, such as strategic planning.

Automation aims to revolutionize the way employees work, the way technology is used throughout the organization, and how important business decisions are made. Whether you need to cut down on manual tasks or make certain workflows faster and more accurate, aiming for automation is one of the biggest steps you can take to generate more positive outcomes sooner and make yourself competitive in future markets.

Building blocks for success in financial process automation

While some businesses grasp the potential of automation quickly, others are still searching for an itinerary in the automation journey. You need more than just the right technologies to build more competitive financial processes; another necessity is a fundamental understanding of exactly where automation will apply itself and why.

Let’s follow with some of the basic lessons companies learn (sometimes the hard way) when trying to start up an automation solution for their financial processes.

Not all RPA is created equal #1

Robotic Process Automation (RPA) refers to any technology used to automate work tasks, which may or may not involve artificial intelligence. While it sounds high-tech, RPA often shows up as merely pushing keys or executing pre-written commands automatically for the employee.

The problem with RPA is that it’s a rather fragile methodology that can’t cope with even minor deviations. That is, RPA bots require an immense investment to implement and maintain. Consequences for the finance team might include:

- Duplicate payments

- Overpaying

- Incorrect pricing

- Tax calculation errors

- Inaccurate purchase orders

Did you know that 61% of late payments are due to errors in the invoice? Without constant quality data and a watchful eye for deviations (which are common in finance), RPA can easily cause all sorts of errors.

Clean up your data #2

A prerequisite to the successful implementation of automation is a clean and accurate stream of input data — in short, processing data quality. Automation relies heavily on the data it’s been given, so it’s worth going through your finance department and learning how data is created, processed, and ultimately used. On top of better automation, better quality data can result in:

- Useful analytics and actionable insights for smarter business decisions in the future

- Increased productivity and a more robust bottom line

- Entirely new business models

Artificial intelligence can shine only when you have your financial data and processes already in order. You need to move to digital formats and work smarter with your master data. This foundation is necessary before you start applying automation.

Your data is flowing — explore how #3

Finance teams ultimately deal with moving transactional data through approval flows. Do you know exactly where your information is being stored, transported, and used? Are you aware of your company’s stance on the following areas?

- How data is stored and formatted

- Sales and purchasing routines

- Approval workflows

- Deviation handling

- Security

This type of knowledge is essential for CFOs and accounting professionals to know if they want to find ways to apply a digital transformation. For instance, if you start using e-invoices to store transactional data digitally, you can reduce the possibility of errors in data entry or the potential of losing any important documents.

Once you have a thorough understanding of all the policies, procedures, and dependencies in your complicated financial workflow, you’ll start to find opportunities to improve them with financial process automation.

Program your processes #4

Financial processes differ depending on the organization, but most of them have a few familiar steps, such as:

- Contracts

- Order and delivery

- Invoicing and payment

- Reporting

For each of these steps, ask yourself what type of validations you go through, how you manage deviations, and what you can do to optimize the workflow. Answers to these questions will give you hints at how automation can apply itself effectively.

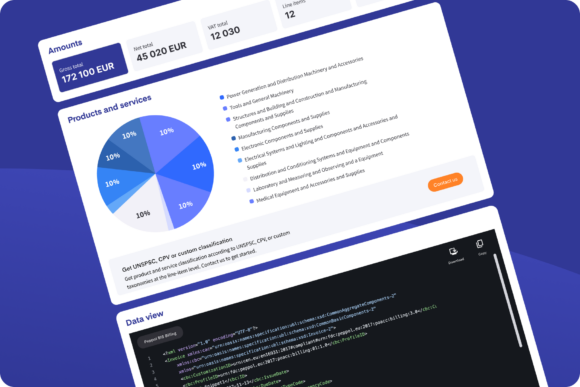

Financial process automation with Qvalia

Finance is heavily data-driven and filled with document processing and repetitive tasks. It’s a prime candidate for automation, but installing it right is a challenge today’s CFOs are facing. From deviation management to data quality, finding the right tools to improve financial processes is essential.

Sign up with Qvalia today to find out how we can digitize, automate, and analyze your spending activities.

Get the ebook!

Download the Automation for CFOs guide for practical lessons in financial process automation and how to move your finance team forward.