Transactions make your business tick. The essential task of ensuring that you get paid for products and services you sell – and naturally pay the right amount for your purchases – places accounts payable and accounts receivable teams at the core of any organization. How much are you prepared to pay for these processes to run smoothly?

A/P and A/R are information- and often work-intense practices. Despite the ever-increasing digitization of the workplace, finance teams still rely heavily on manual touch-points and costly invoice operator services. It becomes obvious when you dig into the numbers to find the true cost of invoice management.

The cost of invoice management

First and foremost, the cost obviously varies between organizations.

It depends on quantifiable factors like volume and the number of formats handled. A simple ratio between paper and electronic format provides a valuable metric and a glimpse of digital maturity.

But the cost is just as much the result of highly strategic factors: the overall level of achieved automation, the structure of end-to-end processes, and ultimately, the economy of scale. For the enterprise and large public sector organizations, these are crucial factors.

These are the visible costs:

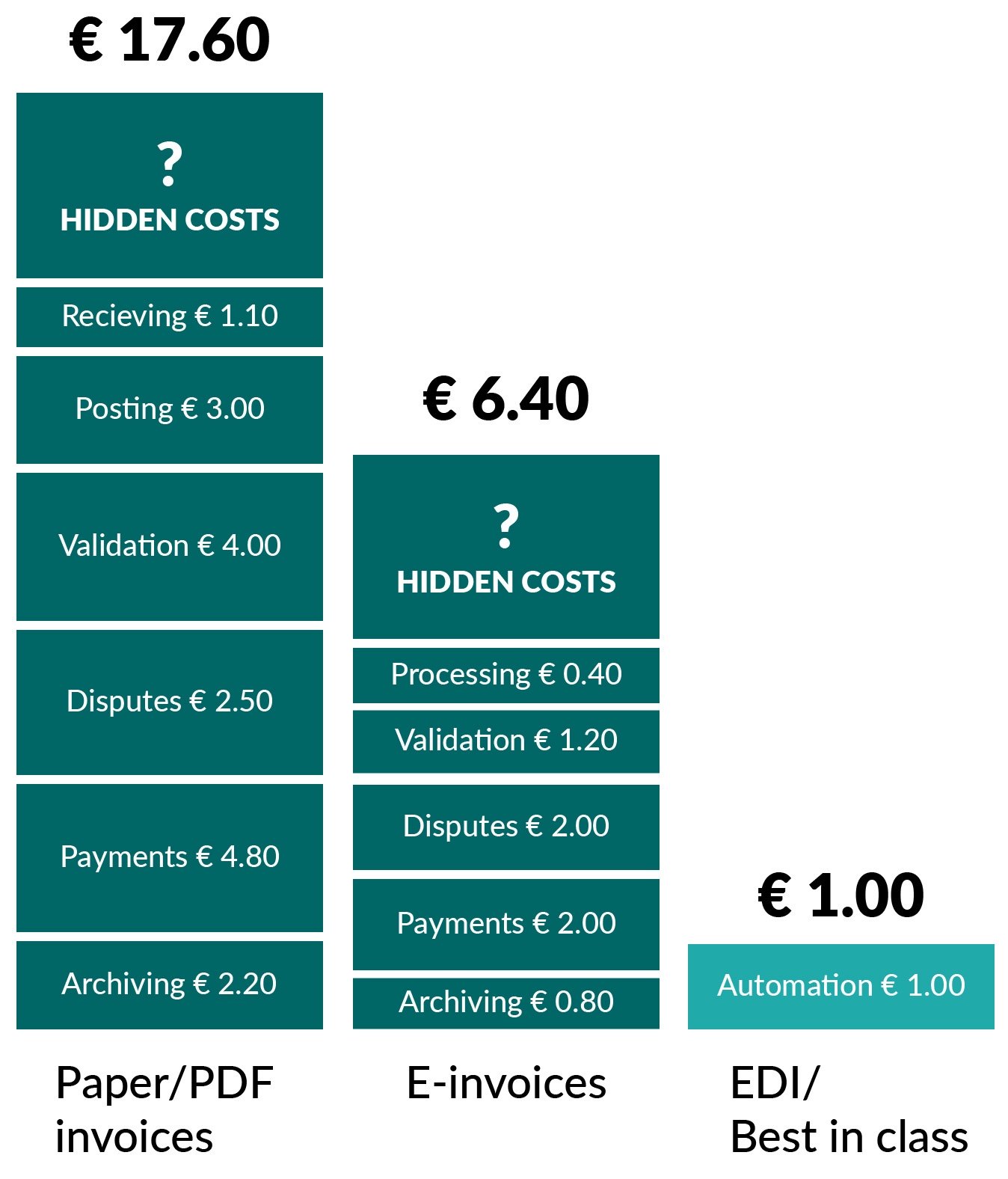

Research by Billentis based on case studies concluded that the price to process an average paper invoice is a staggering EUR 17.60.

E-invoices managed in semi-automated processes reach EUR 6.40 on average. Businesses utilizing Electronic Data Interchange (EDI) integrations such as as access to business networks like Peppol and connecting buyer and seller directly, can lower the cost to EUR 1.

E-invoices aren’t enough

E-invoices, instead of analog formats, put some ease into the processes. No doubt about it. Instant and lossless communication between buyers and sellers is an important step forward in the digital transformation of finance operations.

The e-invoice volume grows steadily at some 10-20% each year. It is accelerating as a result of EU directive on electronic invoicing in public procurement.

Hidden costs

However, there is still a long way to go. Billentis states in the report that some 90% of all invoices globally are still processed manually. And despite increasing automation capabilities, 30% of all invoices are deviant and must be processed manually. There is room for improvement.

Invoice management creates hidden costs as well. Overpayments, double payments, wrongly managed VAT – the list of hidden pitfalls is long—and not visible in a straightforward cost estimate.

These mistakes are sometimes discovered, thus adding to your organization’s workload, but often they slip through the cracks. In any case, the result hurts the bottom line as up to 1% risks being lost in the transaction.

Moving away from paper and PDFs and adopting e-invoices and modern invoice management software is undoubtedly the fastest solution for organizations to increase efficiencies, reduce costs, and ultimately reach their automation potential.

Get the report: The cost of accounts payable errors.

Download report

Get unique insights into the total cost of accounts payable errors. We’ve analyzed 20 million invoices and account postings from some of the largest companies and organizations in the Nordics to determine the true cost of finance process challenges and inefficiencies. Get the report.