The traditional method of handling invoices, fraught with manual tasks and potential errors, has long needed a transformative solution. Invoice automation, a collective term for technologies that revolutionize how businesses manage their financial processes, is a game changer for finance, accounts payable, and receivable teams.

In this blog post, we’ll explore the technologies behind invoice automation and which tools you need to get started.

1. Business messaging and network access

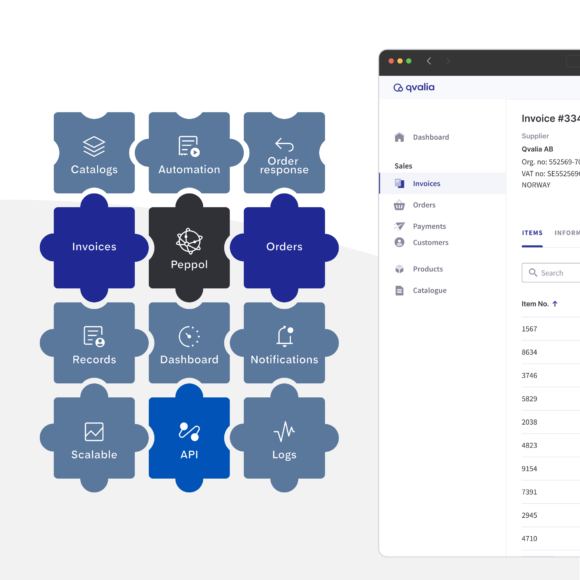

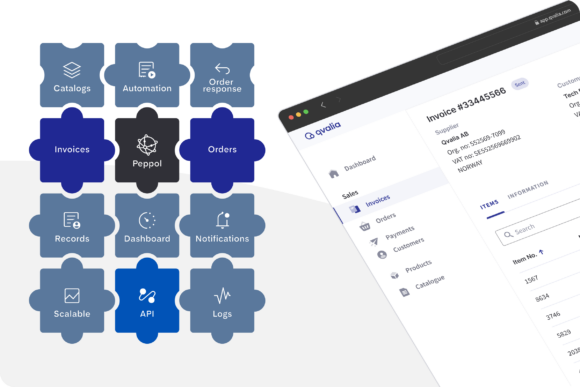

In the realm of invoice automation, using an access point to a business network, also known as an e-invoice service provider or VAN operator, is a pivotal technology to drive efficiency and automate transactional and financial processes. Why? Fully electronic invoice data is structured, machine-readable, and enables instant exchange without losing data or quality.

One such network that exemplifies these benefits is the emerging Peppol network, representing an ideal network choice for businesses looking to streamline invoice processes.

Benefits of accessing Peppol business network

Global reach: An access point to a business network, particularly Peppol with some 44 connected countries, offers international connectivity, enabling organizations to seamlessly exchange electronic invoices with partners worldwide. Reach is essential for businesses operating internationally, ensuring they can navigate diverse regulatory environments and formats effortlessly.

Efficiency boost: The automation enabled by e-invoices reduces manual data entry and minimizes errors. This efficiency translates into significant time savings and cost reductions, allowing companies to allocate resources strategically.

Accelerated payments: Invoices transmitted through the Peppol network are processed in real-time or near-real-time, expediting payment cycles. This rapid turnaround enhances cash flow and strengthens supplier relationships by ensuring timely settlements.

Enhanced security: Security is paramount in financial transactions. Peppol employs robust compliance, encryption, and authentication mechanisms, ensuring the secure transmission of business sensitive invoice data.

Scalability: Whether a small startup or a large enterprise, the Peppol network is adaptable to organizations of all sizes. Its scalability allows for seamless adjustments to varying invoice volumes without requiring extensive monitoring or upgrades.

Environmental responsibility: Electronic business messages reduce paper consumption, aligning with ESG business goals and minimizing carbon footprints.

Learn more about how to get started with Peppol Access Point.

2. Optical character recognition (OCR)

Optical Character Recognition (OCR) is a transitional technology, bridging the gap between a paper-based world and structured 100% digital information. Nevertheless, it’s critical to maintaining smooth accounts payable operations for many businesses. It’s also a technology that has advanced in recent years, not least due to the revolution in AI.

OCR enables machines to interpret and convert human-readable text from image files, such as PDF invoices, into machine-readable data. By employing advanced algorithms, OCR technology accurately scans and extracts data from digital files, ensuring that relevant information is precisely captured. This technology is the starting point for digitalizing processes and automating the data extraction process, which helps reduce manual data entry tasks and the associated human errors.

Learn more about how to start with OCR technology and automatically convert PDF invoices into XML data format.

3. Machine learning and artificial intelligence (AI)

The marriage of machine learning and artificial intelligence plays a pivotal role in the evolution of invoice automation. Few have missed, for example, the recent breakthroughs in LLMs, Large Language Models.

These cutting-edge technologies empower automation systems to become increasingly intelligent and adaptive over time. By analyzing large volumes of data, AI algorithms can recognize patterns, identify anomalies, and continuously improve the accuracy of invoice data extraction. Businesses can implement AI to structure and categorize their financial data for real-time spend analytics and automate accounting more precisely.

Machine learning algorithms also contribute to the automated approval process. Over time, the system learns from historical data to better predict approval patterns, reducing the need for manual intervention in routine approvals and enabling staff to focus on exceptions and more strategic tasks.

Here’s more information about implementing AI to structure and analyze your data.

4. Workflow automation

Workflow automation is a crucial component of invoice automation technology. It enables organizations to design and implement customized invoice processing workflows tailored to their unique business requirements. Through intuitive user interfaces, businesses can define approval hierarchies, validation rules, preposting, and exception-handling protocols.

Automated workflows ensure that invoices follow a predefined path from submission to final approval, minimizing delays and bottlenecks in the process. This enhanced visibility and control foster better team collaboration, improve transparency, and enable timely decision-making.

Here’s how to implement workflow and invoice approval processes.

5. Integration with accounting systems

To unleash the full potential of invoice automation, seamless integration with existing accounting systems is imperative. Modern automation solutions are designed to integrate with popular accounting software and enterprise resource planning (ERP) systems effortlessly.

When an invoice is approved, the automation system transfers the validated data to the accounting system, eliminating the need for manual data transfer. This integration streamlines the payment process and ensures data consistency across various financial platforms, reducing the risk of errors and discrepancies.

6. Cloud computing

Inevitably, business processes are continuously moving to the cloud.

The advent of cloud computing has played a significant role in making invoice automation accessible to businesses of all sizes. Cloud-based invoice automation solutions offer numerous advantages, including scalability, cost-effectiveness, and flexibility.

By hosting the automation system in the cloud, businesses can access their invoice data and processing capabilities from anywhere, anytime. Cloud solutions also relieve businesses of the burden of managing infrastructure, maintenance, and software updates, allowing them to focus on core business activities.

Next step

The era of manual invoice handling and tedious image files and their associated inefficiencies is gradually giving way to the seamless integration of automation technologies into financial workflows.

Invoice automation is a testament to technology’s transformative power in revolutionizing financial processes. Companies can unlock new efficiency, accuracy, and transparency levels in their invoice-processing operations through sophisticated technologies such as business messaging network access, OCR, AI, workflow automation, and cloud computing.

As these technologies continue to advance, invoice automation will undoubtedly become an indispensable tool for businesses seeking to thrive in an increasingly competitive and fast-paced global market.

Get inspired to take the next step — download our e-book Automation for CFOs today.