Transactions, technologies and trends

Category: Purchase-to-pay

Purchase-to-Pay (P2P)

Purchase-to-Pay (P2P) is a comprehensive business process encompassing all procurement stages, from requisition and supplier selection to payment and reconciliation. It involves coordinating departments and systems to optimize purchasing activities, enhance cost control, and ensure compliance with internal and external regulations.

Key stages in the purchase-to-pay process

- Requisition: The process begins with a requisition, where employees or departments formally identify their need for goods or services. This step initiates the procurement workflow.

- Supplier selection and sourcing: The procurement team evaluates potential suppliers, negotiates terms, and selects the most suitable vendor based on quality, cost, and delivery timelines.

- Purchase Order: After supplier selection, a purchase order is issued detailing the requested items or services, agreed-upon terms, quantities, and prices.

- Receipt and inspection: Upon delivery, the received goods or services are inspected to ensure they align with the purchase order and meet quality standards.

- Invoice processing: The supplier’s invoice is matched against the purchase order and delivery receipt in a “three-way match” process to verify accuracy and prevent discrepancies.

- Approval Workflow: Invoices are routed through an approval process involving relevant stakeholders to ensure compliance with procurement policies and internal controls.

- Payment: Once approved, payments are executed according to the agreed terms, ensuring timely and accurate fund transfers to the supplier.

- Reconciliation: The process concludes with the reconciliation of invoices and payments against financial records to confirm accuracy and resolve any discrepancies.

Benefits of an effective P2P process

- Cost control: An efficient P2P process enables better cost management by streamlining procurement, tracking spending, and reducing non-compliant purchases.

- Operational efficiency: Automation and digital tools reduce manual interventions, shorten procurement cycles, and minimize administrative overhead.

- Compliance: A structured P2P system ensures adherence to procurement policies, regulatory requirements, and industry standards.

- Improved supplier relationships: Clear communication, consistent processes, and timely payments foster strong supplier partnerships.

- Data-driven decision making: The P2P process generates valuable data insights, enabling organizations to analyze spending patterns, evaluate supplier performance, and identify opportunities for cost optimization.

The role of technology in P2P

Integrating advanced technologies, such as electronic invoice management solutions, e-procurement platforms, automation tools, and analytics software, significantly enhances the Purchase-to-Pay process. These solutions streamline workflows, improve accuracy, and provide real-time visibility into procurement activities. By leveraging these tools, organizations can maximize the value of their procurement efforts while minimizing risks, inefficiencies, and costs.

Explore our articles to learn more about the digital transformation of Purchase-to-Pay processes.

Integrated Digital Trade (IDT) refers to the seamless exchange of goods, services, and information between companies through digital platforms and technologies.

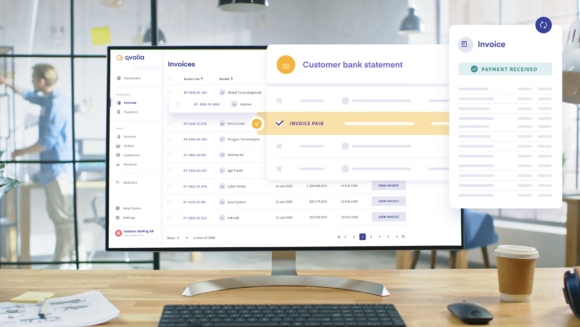

Invoice automation, a collective term for technologies that revolutionize how businesses manage their financial processes, is a game changer for finance, accounts payable, and receivable teams.

If you don’t know where your money is going, you run the risk of losing your budget to maverick spending, misallocated resources, efficiency bottlenecks, …

Qvalia is a finance automation platform built for scale. It simplifies redesigning and automating daily finance tasks in your company. Think of it as …

In our third annual report in the Lost in transaction series, we analyze errors in accounts payable and accounting processes for some of the …