Every business should be familiar with the order-to-cash process. The steps in this process are crucial to achieving operational efficiency within your organization, its finance department, and accounts receivable.

So, what steps does the O2C process cover?

The order-to-cash process can be broken down into the following general steps: order management, credit management, fulfillment, shipping, invoicing, accounts receivable, payment collection, and reporting.

Read on to learn more about these individual steps, how they impact your organization, and what an effective order-to-cash process looks like.

Order management

The starting line for the order-to-cash process is when the customer places an order, which can take the form of:

- An email to your sales team

- A phone call to a service representative

- A checkout on an e-commerce website

Regardless, the order management phase begins here. Use e-orders to ensure speed and data quality, and automation to notify everyone involved about the order and the next steps for it. Only then can you ensure fast fulfillment and order accuracy. Implement B2B payment gateways if possible to automatically create e-orders from your customers. The result will ultimately be a satisfied customer and more revenue for you.

Credit management

If this purchase is the first for a particular customer, then credit checks might be in order. Automation can help take care of most of the work, while finance employees can cover any cases that require more comprehensive oversight.

Credit management is largely the work of the accounts receivable department, as it allows qualified customers to move on to fulfillment while ensuring that your business only offers credit when it needs to.

Fulfillment

From the vendor’s side, it makes sense to have proper inventory management practices in place so that you aren’t out of stock when a new order comes in.

Automation solutions make sense here to keep real-time records when they are required. They can also help digitize your orders so that the relevant details are always readable. Handling them through the traditional paper route can lead to errors and inefficiencies.

In the case when you cannot fulfill an order, notify the customer and issue a cancellation to prevent further billing frustrations.

Shipping

The shipping phase of order-to-cash relies heavily on accurate logistics to ensure reliability and speed. Shipping times and pickup schedules are important for making sure orders reach their customers on time.

Invoicing

Invoicing delays are notorious for ruining the customer experience. Delays and inaccuracies are inconvenient for everyone, so auditing your invoicing process helps you plan your cash flow and minimize client frustration.

E-invoicing, a long-term trend, moves the paperwork into the digital workspace. Digital management is more efficient and gives you more control over the content and accuracy of your invoices. The advantages of e-invoicing are numerous.

- Faster payment: A buyer who receives an invoice must painstakingly route it through the approval process. E-invoicing enables a faster payment and thus better cash flow without missing a step of approval.

- Lower costs: The increased accuracy of e-invoicing solutions and its removal of paper-based workflows cuts down on internal operation-related expenses.

- Better client satisfaction: With fewer late payments, rejected invoices, and general mistakes, a more efficient payment system results in a better customer experience that will have buyers coming back to you.

- Compliance: Thanks to better awareness and more controls over the whole process, e-invoicing helps your business stay compliant with regulatory demands regarding accounting and financial management.

It’s for this reason why invoicing automation has come to light. Invoices require a notorious amount of manual work and data points, including the order date, shipping times, product specifics, and others. Reducing that load off your staff results in significant performance improvements.

Accounts receivable

The accounts receivable department is responsible for overseeing any outstanding invoices and responding to any errors that could delay payment. These staff members usually must dive deep into the data of the order-to-cash system so that they can issue a revised invoice as soon as possible.

Payment collection

If your accounts receivable department is efficient enough, it will process payments from customers fast enough for your O2C process to accept. Otherwise, you risk causing friction with your clients and messing up your cash flow estimates in the long run.

On the other side of the coin, you also have to plan for customers being late on their own payments. In this case, the system must automatically notify those clients if they attempt to make further purchases. Your finance teams must similarly review overdue payments and make decisions based on debt forecasts.

Reporting

Awareness of what’s going on in your order-to-cash process matters because it lets you understand how these financial activities impact the rest of your company:

- Relationships with suppliers and clients

- Details regarding the sales cycle

- The quality of customer service

- The consistency with which you handle invoicing

- Compliance (SAFT-T, CTC etc)

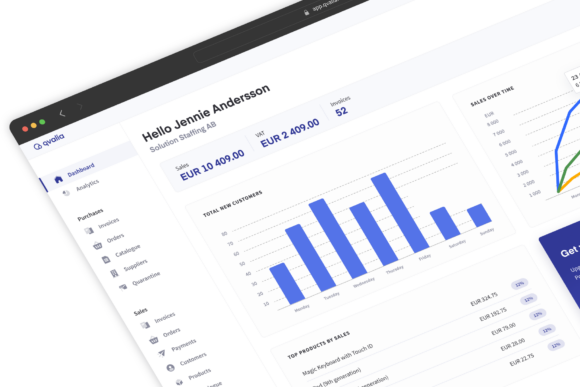

That’s why many software programs have reporting and analytics functions built-in. Order-to-cash is a heavily interconnected process; one delayed step can cause problems for everything else. Management often uses reporting tools to dig out the small issues and address them for better O2C in general.

Simplify the order-to-cash process with automation

Order-to-cash is multifaceted and takes a lot of effort to manage effectively. But did you know that you don’t have to do all these steps manually?

Navigating today’s complex O2C processes and improving sales in B2B markets is all about having the right tools for the job. That’s why O2C automation is becoming increasingly popular.

With Autobilling, you can automate the invoicing process from initial order to final reports, as well as digitize all invoices, PDF files, and other documentation for easier processing and auditing. Book a demo today to get started.