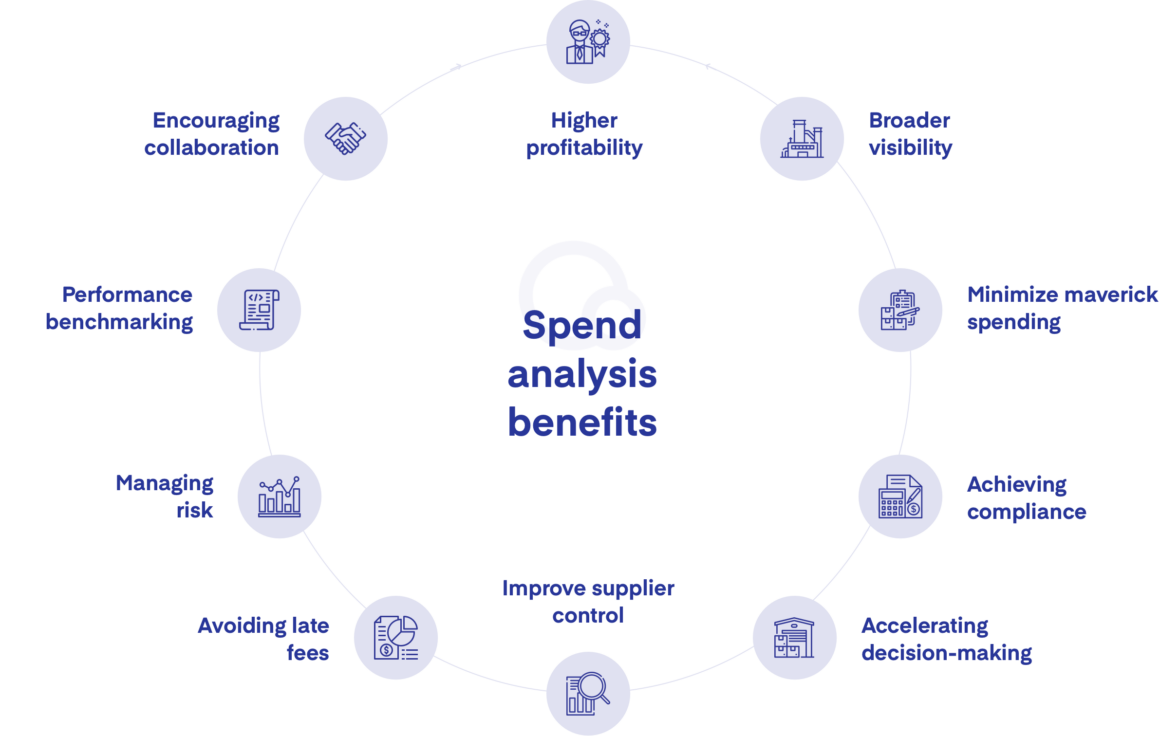

What are the spend analysis benefits? A basic definition of spend analysis would define it as the use of spending data, purchasing policies, and procurement processes to find ways to lower costs, negotiate better contracts, and have better relationships with vendors. In fact, spend analysis done right can decrease the cost of the procurement process by nearly 50%.

Spending and procurement at the business level can be complicated, with many different vendors to manage and options to pursue when it comes to purchase orders, discounts, and bulk orders. Despite this, experts agree that the benefits are well worth it, contributing up to 20% of cost savings for every new dollar.

Spend analysts have to work with various financial statements, purchase orders, contracts, and other documentation. It’s clear that data drives most of the insights in spend analysis, and digitization is the key to making that process more efficient.

New cloud software such as Spend Monitor, a solution for real-time effortless insights, has enabled companies to quickly implement robust analytics capabilities, but what are the spend analysis benefits? Read on to learn more about the key benefits you can achieve through a successful spend analysis program.

1. Empower category management

Have you ever heard of a concept called the “spend cube”? It’s a step present in almost all procurement processes, where the analyst divides corporate spending into different categories. It’s the best way to allocate responsibility for spend management.

Category management plays a significant role in spend analytics but also takes a large amount of time to complete since you need to collect all kinds of spending data from disparate sources and clean it up for proper analysis.

2. Minimize maverick purchasing

Sometimes, it’s easier to make a quick purchase rather than look into how it would fit into the spending plan of the business. Maverick spending occurs when these quick decisions result in hasty contracts and inefficient transactions.

Procurement analysis helps prevent these purchases and gets you better prices and contracts for what you pay for. It’s also a strong deterrent against legal noncompliance and unapproved suppliers.

3. Improve supplier control

One of the first optimizations a spend analyst team makes is tuning the supplier profile of the organization. By recognizing inefficient vendors and reducing the overall number of suppliers, you can manage tail spend and cut down on costs.

Imagine a scenario where two separate departments are buying approximately the same product from two different vendors. Supplier control would discover that both departments can make a joint order from one supplier to simplify the transaction.

4. Identify price arbitrages

At the same time, it sometimes makes sense to purchase the same item in different markets to exploit minor differences in price. These short-term exchanges might turn out in your favor if you have the data analytic capabilities to take advantage of them.

5. Introduce external benchmarking

No matter your internal efforts, the prices you pay are ultimately decided by market dynamics and what happens outside the control of your company. External benchmarking looks at your procurement spend in the context of changing prices in the market.

How does your procurement stack up with the rest of the market? Benchmarking alongside market development (specifically market indexes) will properly compare yourself against your performance in the past and the market in general.

6. Introduce internal benchmarking

Benchmarking can also occur on an internal level. How do you compare financial performance across different business locations? Is one location underperforming and in need of attention?

7. Raising working capital

By experimenting with various payment terms, spend analysts can change how much working capital the business has access to over time. Making sure you have enough cash on hand at any point is an important job.

Companies usually have “accounts payable” and “accounts receivable” teams for this purpose, but spend analysis still plays a role in managing the budget on a real-time basis.

8. Align finance and procurement

Often separate departments in a business, finance, and procurement must work together to get the most value out of corporate spending. Specifically, procurement must convince stakeholders in the business to accept its spending changes.

Most managers are reluctant to change suppliers according to the advice of another department since they lose a degree of control over their raw materials and resources. By making sure everyone is on board with the spend analysis benefits, the business can collaborate together to draw out that extra value.

9. Increase contract compliance

What’s the best way to maintain supplier relationships? Ensure that you are in full compliance with agreed-upon terms. Vendors value contract compliance in their client businesses and will likely stick with you for longer or even offer discounts if you do so. Always make sure payments come in on time, for instance.

10. Track and reduce inventory levels

Spend analysis ties in heavily with inventory stock management. Having too little stock results in disruptions in your ability to manufacture products and offer services to your clients. Having too much stock results in unused resources. Both cases result in lost revenue for the company.

Spend analysis can sync your spending with your output, keeping inventory levels ideal no matter how much demand from your consumers fluctuates.

Learn more about spend analysis benefits in our ebook “A guide to spend analysis: How to enable data-driven decision-making in procurement“. Download it for free.