OpenPeppol is working on new improvements and optimizations for the Peppol network in a journey to make it the de facto global standard for B2B transactions; e-invoicing, e-orders, catalogs, punch-outs, and more. The capability of continuous transaction controls is one of the most disruptive.

The 4-corner model of exchange has made adoption and usage much easier for businesses and the public sector. And we’re already seeing plans for a five-corner model, where governmental tax authorities can participate in checking for tax liability and ensuring compliance amongst vendors and buyers.

One of the most interesting use cases in a Peppol 5-corner model is the implementation of Continuous Transaction Controls (CTC). What does this new approach do? And what implications does it have for the Peppol network as a whole? Read on to find out the current developments for this major upgrade in how we carry out B2B transactions.

What do continuous transaction controls do?

Government tax authorities inspect e-invoices and check for compliance at the transactional level. They collect data on business activities in real-time using cloud services to ensure tax liabilities are properly kept track of in the B2B e-commerce and procurement space.

Under the Peppol network, this operation can occur even for international, cross-border transactions. The proposed 5-corner model will add government tax bodies as an extra corner (alongside a designated Peppol access point) so governments can monitor business transactions.

How are they an improvement to traditional methods?

In the past, governments would perform retroactive audits to learn about transactions after they occurred. This process was inefficient and potentially inaccurate as it relied on the quality of the data collected by the business.

Continuous transaction controls, by contrast, use real-time data obtained directly from the business’s transaction processing activities.

What is the current adoption rate?

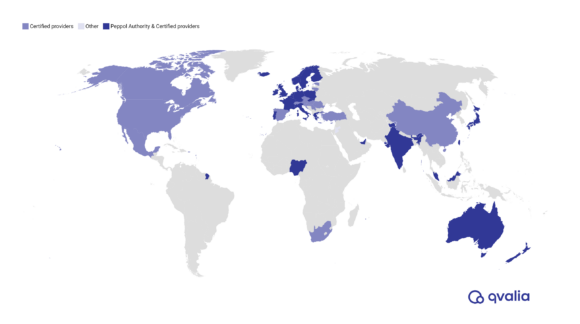

CTCs have already seen some adoption, with new countries implementing the technology soon.

- Spain requires businesses to report transactional data quickly through automated XML feeds

- Italy’s Sistema di Interscambio (SDI) mandates real-time B2B e-invoicing through the government portal

- Hungary’s Real Time Invoice Reporting (RTIR) requires immediate reporting of invoice data.

Other countries have been experimenting with CTCs, and three of them have currently announced future implementations: Poland, France, and Romania. Countries like Sweden are also investigating the technology.

In fact, the European Union, in general, is looking to adopt CTCs with each country working on its own iteration. These fragmented reporting requirements have made the EU Commission attempt to harmonize them all within the region, leading to a possible change to the EU VAT Directive 2006/112/EC. Peppol is planned to be used as the core infrastructure.

What models of CTCs exist around the world?

Various countries around the world have their own approaches to continuous transaction controls. A few of them are detailed below.

Clearance

One of the earlier solutions picked up by some of Latin America was the clearance model. Businesses would authorize transactions with the government before forwarding them to the actual client.

Countries that have adopted some form of clearance CTC include Mexico, Chile, Peru, India, and Saudi Arabia.

Reporting

The reporting model is essentially the reverse of the clearance model. The transaction happens first before the need to validate the invoice with the tax authority.

Centralized

The EU Procurement Directive requires public entities to accept e-invoices, and today, B2G (business-to-government) e-invoicing is becoming more and more mandatory. You can find centralized CTC practices across Europe as a result in countries like:

- Italy

- Belgium

- France

- Portugal

- Spain

Even Poland is planning on adopting the centralized model, which is likely to be implemented in the nation in 2023.

RTIR

Standing for real-time invoice reporting, RTIR is a system where the vendor must report part of the invoice to the tax authority in real time after the sale is made. There are regulations on:

- The exact format of the invoice

- Information like the document type and name

- VAT data like the VAT numbers of both parties and the amounts

The RTIR model was originally established in South Korea and Hungary where invoice exchange did not have many regulations yet.

Peppol CTC

The Peppol network today uses designated access points, which are service providers that can send and process documents in the BIS format. The current 4-corner model used by Peppol is actually not a CTC model, as it does not yet include tax authorities as one of the corners.

However, new developments in the network are suggesting the inclusion of a tax authority as a fifth corner, culminating in the appropriately-named 5-corner model.

Peppol networks are evolving to support continuous transaction controls

In a traditional 4-corner model, a sender and a recipient both work with their own Peppol access points to communicate with one another. The four corners here include both parties and both of their access point service providers.

The upgraded 5-corner model will add tax authorities to the network as a point of audit. What results is an automated and fully integrated approach to taking control of tax liability and compliance.

Keeping up with Peppol

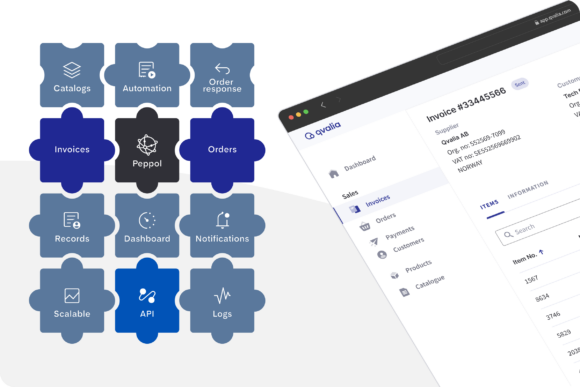

Are you looking to embrace the shift to Peppol? Keeping your business competitive in today’s digital landscape requires having the right financial platforms to drive efficiency and growth.

Discover how Qvalia’s scalable and cost-efficient approach can fast-track your transition to the Peppol network. Our rapid integration allows you to send and process electronic documents seamlessly, access efficient tools for automation and analytics, and simplify your ability to stay compliant with evolving tax regulations in the future.