The shift from traditional paper invoicing through PDFs to electronic invoicing (e-invoicing) marks a new paradigm of modern business operations. In their latest market research report, Billentis defines this evolving market, its characteristics, and definitions.

E-invoicing refers to the electronic transmission of invoices between suppliers and buyers, streamlining the invoicing process and significantly reducing the need for manual intervention. This evolution is not just a technological upgrade but a fundamental change that impacts efficiency, compliance, and business transparency.

E-invoicing emerged as businesses sought ways to automate invoicing processes, reduce errors, and enhance transactional accuracy. Over time, it has grown from a niche practice to a global standard, driven by technological advancements and increasing regulatory requirements.

This blog post summarizes e-invoicing’s role in today’s business landscape, its characteristics, definitions, global adoption, and future outlook as defined in Billentis’s recent report The global e-invoicing and tax compliance report: Watch the tornado! (2024).

E-invoicing market characteristics

Understanding the terminology associated with e-invoicing is essential for grasping its scope and impact. In the context of Business-to-Business (B2B) and Business-to-Government (B2G) transactions, e-invoicing specifically refers to the digital transmission of invoices between suppliers and purchasers. This excludes data exchanges with tax authorities for reporting and control purposes, which is often referred to as e-reporting.

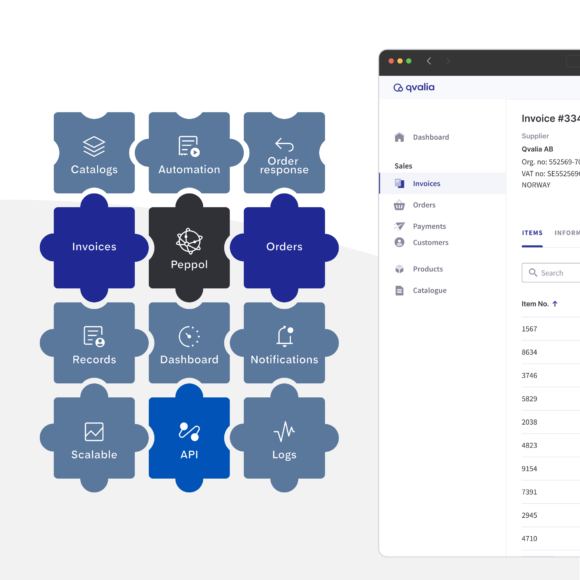

In the Western hemisphere, e-invoicing signifies the digital transmission of invoices across various sectors, including B2B, B2G, and Business-to-Consumer (B2C) contexts. The European Union (EU) legislation, for example, mandates the electronic issuance and receipt of Value Added Tax (VAT) compliant invoices and has established Peppol as an open network to facilitate the exchange. This standardization ensures that e-invoices meet specific requirements for authenticity, integrity, and legibility and can easily be exchanged between business partners.

Differences between e-invoicing and e-reporting

While e-invoicing and e-reporting share technical platforms and data exchange methods, they serve distinct purposes. E-invoicing involves the complete digital invoice exchange between suppliers and buyers, serving as the official invoice for tax and transactional purposes.

In contrast, e-reporting to tax authorities involves submitting invoice data for audit and regulatory compliance, which may include extracts or summaries of the invoice details.

Transition from paper to digital invoices

The transition from paper to digital invoices represents a significant shift in business operations. Traditional paper invoices are prone to errors, delays, and high processing costs. In contrast, e-invoicing offers numerous benefits, including:

- Reduced processing time: E-invoices can be processed almost instantaneously, reducing the time between invoice issuance and payment.

- Cost savings: Eliminating paper reduces printing, postage, and storage costs.

- Improved accuracy: Digital invoices minimize errors associated with manual data entry.

- Enhanced compliance: E-invoicing ensures adherence to regulatory standards and simplifies audit processes.

- Environmental benefits: Reducing paper use contributes to environmental sustainability.

Key types of e-invoices

In the report, Billentis categorizes e-invoices into three primary types:

Legal invoices: These meet tax compliance requirements and include mandatory fields and authentication. For tax purposes, they are preserved as the original valid invoices.

Core invoices: These comply with tax and trade requirements, support automated processing, and include comprehensive data fields for efficient business transactions.

Commercial invoices: Used in specific industries, these invoices contain extensive data fields tailored to support process automation in sectors like healthcare and logistics.

Global adoption and standards

Regional definitions and implementation

The adoption and implementation of e-invoicing vary globally. In the European Union, for instance, e-invoicing is driven by legislative mandates that require businesses to issue and receive VAT-compliant invoices.

In Latin America, countries like Brazil and Mexico have pioneered e-invoicing to combat tax evasion and improve tax collection efficiency. Asia is also seeing rapid adoption, with countries like Singapore and India implementing robust e-invoicing frameworks.

Role of tax authorities

Tax authorities worldwide play a crucial role in driving e-invoicing adoption. By implementing Continuous Transaction Control (CTC) models, tax authorities can ensure real-time or near-real-time transaction processing and auditing. This not only enhances compliance but also reduces the VAT gap—a significant driver for many governments.

Standards and interoperability frameworks

Standards and interoperability frameworks are essential for seamlessly exchanging e-invoices across different systems and regions. One prominent example is the Peppol (Pan-European Public Procurement Online) network, which provides standardized protocols for e-procurement and e-invoicing.

Peppol ensures that different e-invoicing systems can communicate effectively, facilitating cross-border transactions and improving operational efficiency.

As businesses and governments continue to recognize its benefits, e-invoicing will continue to grow.

The shift towards e-invoicing is not just about adopting new technology; it represents a fundamental change in business processes driven by the need for greater efficiency, compliance, and sustainability. As more regions adopt standardized e-invoicing practices and interoperability frameworks, the global business landscape will become more connected, transparent, and efficient.

To get the full story, download the full report.