When saving your business’s costs and improving its efficiency, one of the most promising routes for finance teams is automation. You’ve likely heard about the massive improvements in automation technologies over the past few years alone.

And now, you might think that some automation solution is exactly what your business needs. But is automation the right direction for your business?

While automation can greatly improve efficiency when used wisely, not all solutions are created equal. Many businesses invest in unneeded and unscalable automation and end up blowing their budget on a system that doesn’t improve their core systems that much.

So, how do you know now is the right time for your business to invest in finance automation? That comes down to your business’s automation potential. If you have high automation potential, investing in automation should generate a quick ROI.

By looking out specific ways that automation can improve your business, you can gauge your automation potential fairly easily. Here are three aspects finance teams should examine to determine your business’s automation potential.

1. Analyze your accounts payable routines

Accounts payable is a great place to start for any business for a few reasons. Firstly, this part of your business is labor-intensive and can account for many wasted resources. Secondly, customers can’t see behind the scenes how you process transactions, so they can’t be put off by you improving this part of your business.

Automating your purchase transactions is budget-friendly and simple to implement, so if you can improve this aspect of your business, it’s a great first step to end-to-end automation.

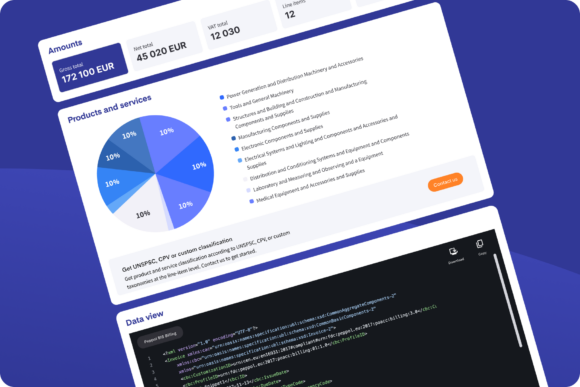

A thorough and potentially lucrative way to analyze purchases is to perform a recovery audit, a financial data-mining consulting service that focuses on identifying erroneous invoice handling, hidden process weaknesses, and capital leakage. Money lost in past transactions due to payment or VAT errors is (in many cases) possible to recover.

2. Check incoming invoices

You should look at how you interact with your suppliers. Is your supplier ledger continuously updated? Are you monitoring for fraud or insolvency? How many of them give you paper or PDF invoices?

The format issue is a natural starting point when digitizing finance processes. Paper and PDF files are a big obstacle to automation, as they almost always require a human to read, interpret, and key in information.

If you can get these analog data formats replaced with digital ones, you will have a much easier time efficiently processing them via automation. With structured input data in your finance process, you’ll be able to transform your processes all the way to accounting and reports. In other words, every source of analog paperwork adds to your business’s automation potential.

Qvalia’s e-invoicing solution was designed for this reason. It’s a robust tool that allows businesses, even your smallest suppliers, to digitize every aspect of the invoicing process and provide you with the structured invoice data you need.

3. Don’t forget your own paperwork

You should not only look at your suppliers’ invoices. Depending on the formats you use, your own invoices and other paperwork might be affecting your efficiency.

If your business has been around for a while, chances are you’re still using paper in some capacity. You may even rely on archaic solutions like the dreaded legacy Excel sheet, filing cabinets, and other outdated software.

Switching from paper to digital invoices might not seem like a particularly impressive change, but it can work wonders for improving your efficiency and reducing costs. But just what kind of benefits does it offer? One 2018 report by account firm EY revealed that:

- The average cost of a paper invoice is 15 euros, while a digital one is 0,30 euros

- A human can process an average of 6,000 paper invoices per year and 90,000 e-invoices

- Paper invoices take around 15 days to process, and 3 days for e-invoices

These are only a few of the main benefits. Switching to a more accessible digital format has many benefits. Overall, this type of automation can benefit almost all businesses, so you should make sure you look for an opportunity to implement it.

Automation potential: What’s next for your company?

Once you know which areas of your business contain the most automation potential, you’re ready to start looking for ways to implement an automation solution. If you appraise your business’s automation potential, the methods that will increase your efficiency the most should come naturally.

Automatic purchase transactions are one easy way to improve efficiency. Another way is replacing your incoming and outgoing invoices with e-invoices, which is key to processing them with an automated system. Once you’ve digitized your paperwork, automating the processing aspect and accounting becomes significantly more straightforward.

If you’re considering digitizing and automating your finance process, practical tips and guidance are available in the ebook Automating Finance—download it for free.