Belgium is entering a new phase of digital tax transformation. On January 1, 2026, electronic invoicing becomes mandatory for nearly all B2B transactions. Every Belgian company – and every foreign supplier selling to Belgian buyers – must be able to send and receive structured e-invoices based on the European EN 16931 standard, typically exchanged via the Peppol network.

For many organizations, the mandate raises questions:

How do we comply? Will our ERP need modifications? Do we need a Peppol service provider? How do we avoid manual steps? How to avoid unnecessary costs and get the most efficient solution for my business?

The good news is that compliance can be extremely straightforward. The fastest and most robust approach is to use a Peppol-native solution that provides both an intuitive online interface and a complete developer API. Qvalia is developed precisely for this scenario.

This guide explains how the mandate works, what you need to implement, and how to get started instantly with Qvalia — whether you are a small business sending a few invoices per month or a large enterprise with complex system integrations.

Understanding Belgium’s e-invoicing mandate

Belgium has adopted EN 16931 as the legal basis for e-invoices and uses the Peppol network as the primary delivery channel. This means that on January 1, 2026:

- All invoices between VAT-registered businesses must be issued electronically

- Format must follow EN 16931 (e.g., Peppol BIS Billing 3.0)

- Delivery must happen via the Peppol network

- PDF is no longer accepted as a valid B2B invoice

- Buyers must be able to receive structured e-invoices

- Non-compliance may incur administrative fines

The mandate covers both Belgian companies and international suppliers invoicing Belgian customers.

Because Belgium already mandates Peppol e-invoicing for the public sector, the infrastructure is in place. What changes in 2026 is scale: the standard becomes universal for private-sector transactions as well.

Why Peppol is the simplest path to efficient B2B transactions

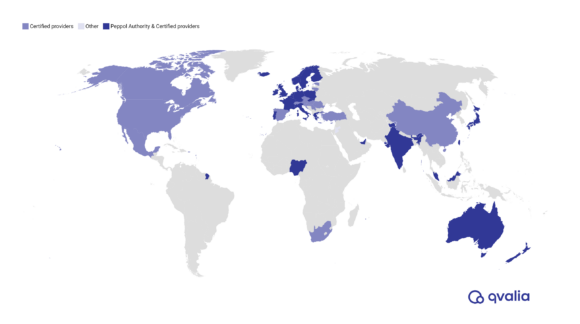

Instead of building custom connections or sending files manually, Peppol standardizes everything:

- International standard

- One format

- One delivery method

- One way to receive

- Automatic validation

- Secure, authenticated exchange

It eliminates the complexity of sending e-invoices to multiple local platforms, portals, or customer-specific endpoints. Once your company and your customer are registered in the network, the invoice is delivered instantly.

Qvalia is an accredited Peppol Access Point, meaning you receive full connectivity and compliance out of the box, and is included in Belgium’s official Software solutions for sending, receiving and processing electronic invoices list on the federal e-invoicing information portal.

Peppol plug-and-play: How to get started

Many companies overestimate the complexity of e-invoicing. With Qvalia, the onboarding process is 10 minutes.

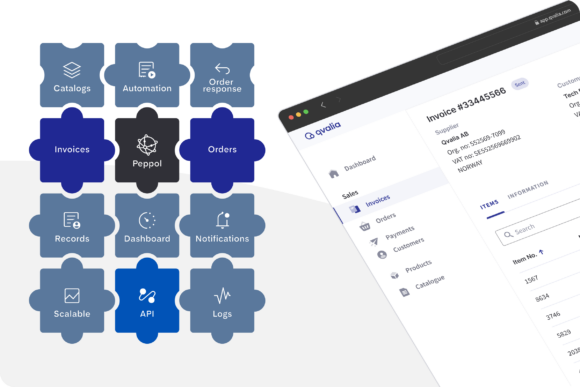

The platform differs from conventional e-invoicing tools by taking a data-first, Peppol-native approach. The platform provides real-time network connectivity and supports the complete set of message types, from invoices to orders and despatch advices. Every transaction is normalized down to the line level, enabling reliable automation even at high volumes, backed by strong uptime and advanced user features. Finance and tax teams get full auditability, developers avoid lock-in, and getting started is easy with a free plan.

For beginners: Use the online platform

Connect by Qvalia gives you everything required to start sending compliant Belgian e-invoices:

- Create, edit, and send e-invoices in the web app

- Automatically validate invoices against Peppol rules

- Store all sent and received invoices in one place

- Send a PDF invoice via email as a fallback

- Instant access to e-orders, e-catalogs, and order management features

- Connector apps are available for common ERPs

- Start for free and scale as you grow

No installation, no configuration, no technical knowledge required.

For professionals: Full Peppol API

If you already use an ERP, finance system, or custom solution, Qvalia enables seamless API-based connectivity. To get started quickly, go to the Peppol API guide.

Developers can integrate:

- Complete set of Peppol messages

- Invoice creation and transmission

- Invoice reception and webhook notifications

- Validation

- Order flows (Peppol BIS Order Only, Ordering, and Advanced Ordering)

- Catalogues, despatch advices, and more

- API or SFTP batch option for large-volume file-based invoicing

Additional features include:

- AI PDF-to-XML capture

- AI pre-posting

- Approval workflow

- AI line-item classification

- Spend analytics

- VAN/EDI messaging

This lets you automate the entire B2B flow: from receiving purchase orders to sending the matching invoice back to the buyer. You can start small with the web app and move into API or advanced automation later — the same platform supports both.

Step-by-step: Become compliant before January 1, 2026

Step 1. Sign up your company and get your Peppol ID

Sign up for a Connect plan. Qvalia assigns your Peppol ID within minutes. This ID is what allows you to receive messages via Peppol.

Step 2. Choose your method

Web app for manual invoicing, connector apps, or API/SFTP integration for automated invoice flows.

Both methods are fully compliant and available according to choice of plan.

Step 3. Validate your customer master data

Belgian customers will be identified by KBO number (BE + 10 digits). Qvalia validates delivery automatically. You can find Peppol IDs in the open directory here.

Step 4. Test sending an invoice

You can send a live invoice within Qvalia or test transmissions through the API sandbox.

Step 5. Go live across your processes

Once you’re sending and receiving via Peppol, compliance is achieved. There is no additional Belgian platform you need to connect to.

Technical guide for developers: Implementing Peppol via Qvalia API

This segment targets engineering teams integrating B2B invoice flows. You can also read our quick guide to Peppol API.

API structure and conventions

Qvalia uses standard REST conventions:

- JSON payloads

- OAuth2 authentication

- Synchronous or asynchronous processing

- Webhook callbacks for asynchronous flows

- Standard HTTP response codes

All API endpoints follow consistent patterns for invoices, orders, validation, and metadata.

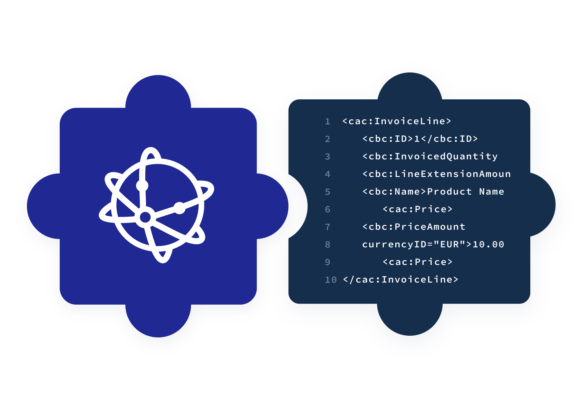

Sending an invoice via API

Developers typically follow this flow:

- Construct an EN 16931-compliant payload

- Submit via the Invoice Send endpoint

- Receive a transaction ID

- Optionally poll status or receive webhook notifications

- Retrieve logs, validation errors, and delivery receipts

Qvalia handles transformation into Peppol BIS Billing 3.0 and network delivery.

Receiving invoices

Incoming invoices can be:

- Pulled (API GET endpoint)

- Automatically pushed to your system through webhooks

- Delivered in batches via SFTP for high-volume environments

- According to plan: each invoice is enriched with metadata, including sender validation, format indicators, line-level data, and UNSPSC classification when applicable.

Validation

The API provides:

- EN 16931 syntactic validation

- Business rule validation

- Duplicate detection

- Line-item checks

- Mapping for cross-system reconciliation

This ensures invoices sent to Belgian customers will not be rejected.

Error handling

Error handling

- Qvalia returns standardized error structures:

- Error code

- Explanation

- Field

- Rule reference

- Suggested fix

This is critical for ERP and automation workflows.

Scaling and performance

The underlying system is built on serverless AWS microservices:

- Horizontal scaling

- Millisecond-level processing

- Consolidated logging

- No queue bottlenecks

- High availability

Suitable for both small companies and enterprise-level volume.

What happens if I don’t comply with Belgium’s e-invoice mandate?

The mandate is backed by enforceable penalties for companies that fail to comply. Entities that do not have the technical capabilities to issue and receive structured electronic invoices via approved channels such as Peppol can incur administrative fines.

The current penalty framework is tiered and increases with repeated non-compliance:

- €1,500 for a first violation

- €3 000 for a second violation

- €5 000 for each subsequent violation

These fines apply when a business persistently fails to meet the mandatory technical requirements, as defined in the Royal Decree implementing the e-invoicing mandate. An administrative warning before fines are levied, and penalties are intended to reinforce the legal obligation to adopt compliant e-invoicing practices.

How to prepare

Even with an strasystem, companies should plan ahead. Recommended preparation:

- Take the opportunity to clean customer master data

- Ensure VAT number validity and format correctly

- If testing is required, Test sending one live invoice before December 2025

- Investigate Peppol order capabilties among your business partners

- Ensure accounting teams understand structured invoices

- If integrating: validate API authentication and production endpoints

Qvalia provides direct support for onboarding and testing.

Get started today

Ready to comply with Belgium’s 2026 mandate? Whether you are a small consultancy or a multi-entity enterprise with complex billing, you can be fully compliant in minutes. Start for free with a Connect and expand into API-based automation when needed.