AP automation for any business

Automate supplier invoice management and streamline accounting with a full-suite digital solution from data capture to posting and approval. Analyze spending in real-time and in full detail with AI-classified line items.

Our platform enables a complete digital process from purchase to pay with unified, validated, and structured data.

Manage supplier invoices

Invoice OCR

PDF invoices are instantly converted into structured XML using AI. Invoice OCR supports PDF, PNG, and JPEG formats.

Electronic invoices

E-invoices from your suppliers are seamlessly received and processed. Supports Peppol BIS Billing and standard EDI formats.

Compliance and validation

Supplier invoice content is automatically validated for compliance and quality based on your requirements, ensuring enhanced data control.

Invoice management

Unify and transform supplier invoices into your data format. Benefit from invoice OCR, Peppol network access, and instant deviation handling for efficient operations.

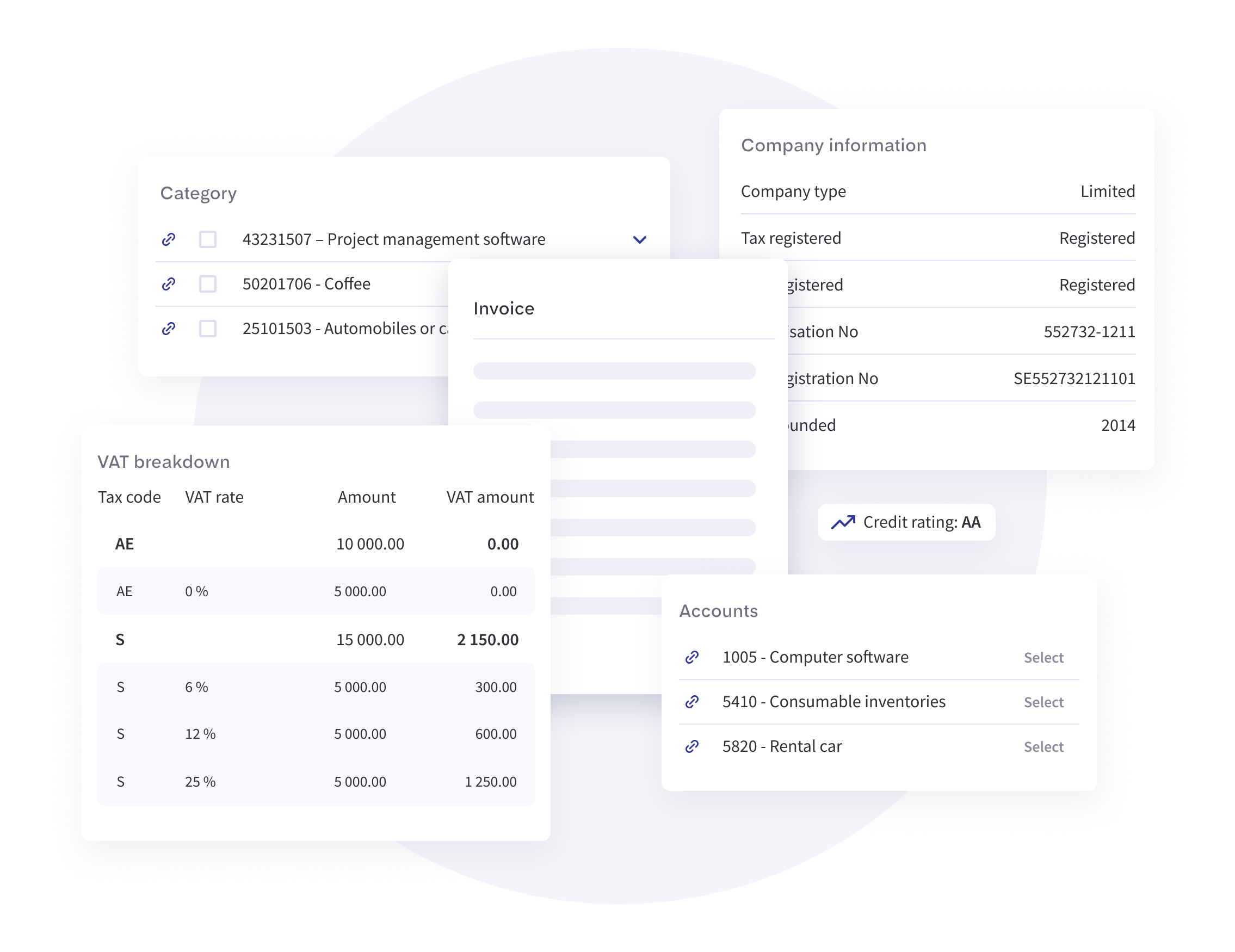

AI posting and data enrichment

AI-driven posting simplifies accounting, while automatic line-item classification provides immediate spend analysis insights.

Workflow optimization

Speed up approvals and reduce workload with a swift, customizable workflow. Enhance partner collaboration through a user-friendly supplier portal.

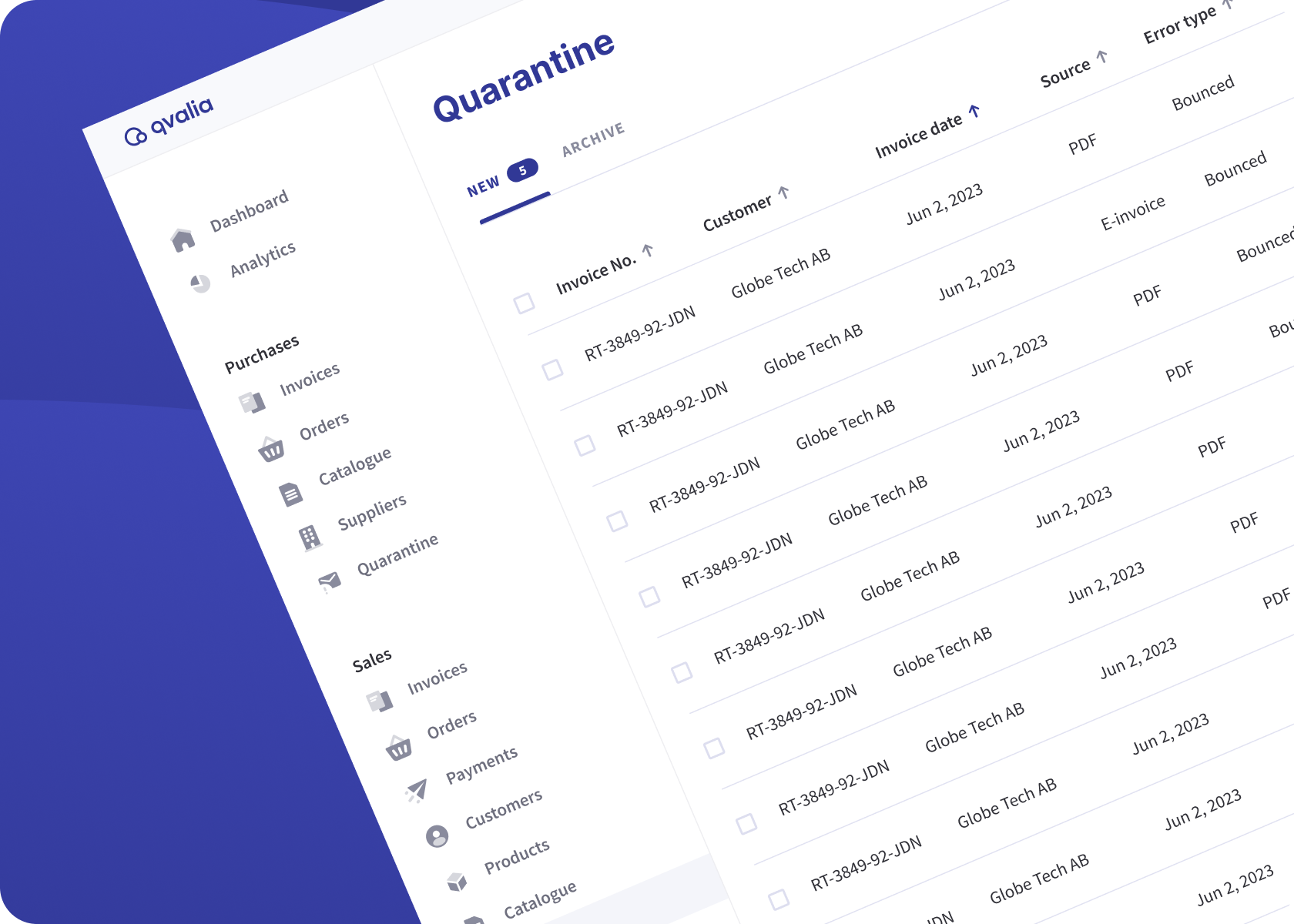

Automated deviation management

Effortless handling of incorrect invoices with automatic return to the sender for corrections or easy management in the built-in quarantine. Your data quality is ensured with 17 invoice content checkpoints and custom validations per your requirements.

Dedicated AI for posting and data enrichment

Advanced transaction AI improves accounting and analytics. Automated invoice posting boosts efficiency in your accounting process. Line item products and services are categorized using, for example, UNSPSC for immediate analytics insights.

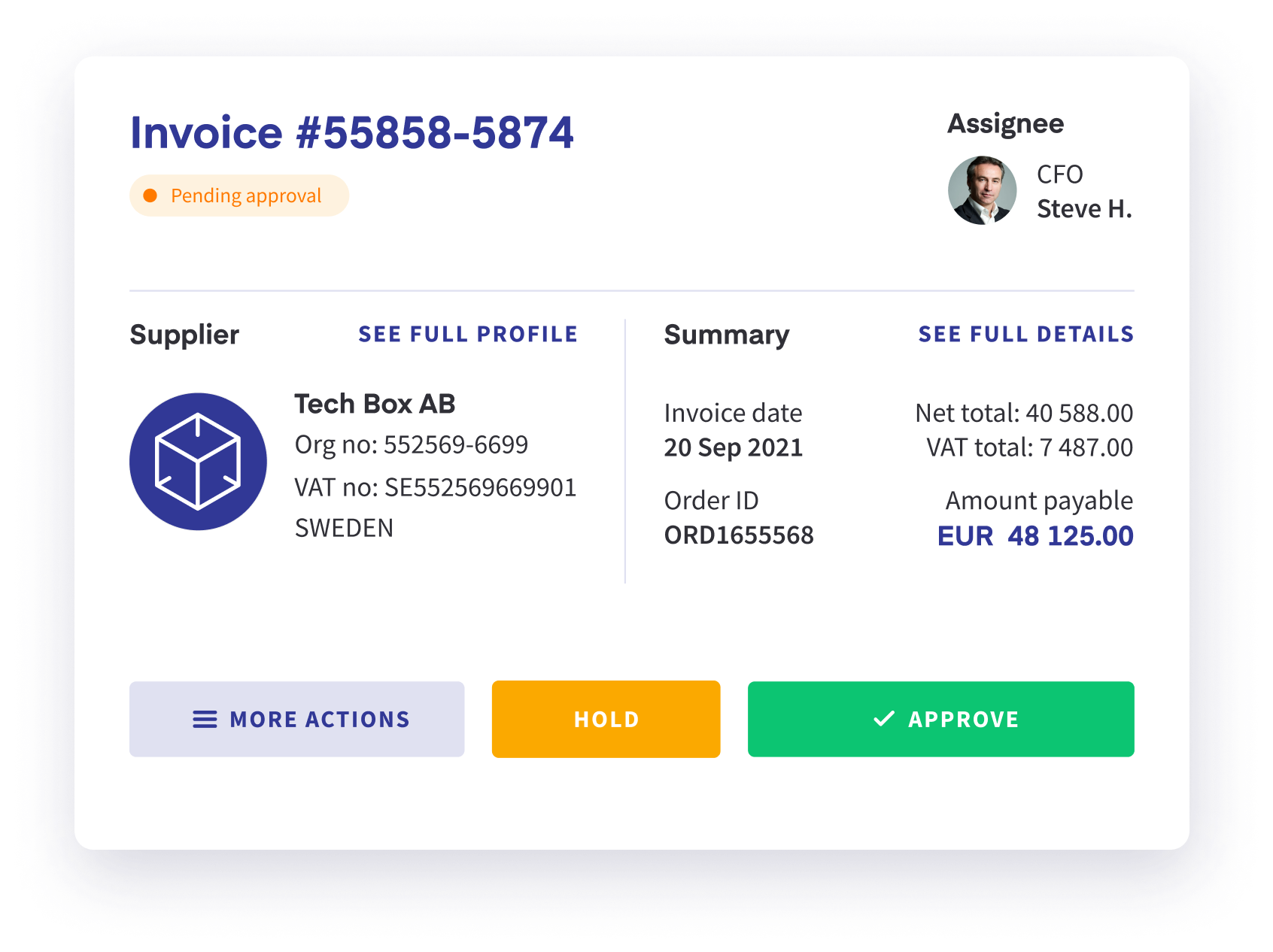

Approval workflow

Streamline invoice approvals for optimal accounts payable performance. Customize workflows with hierarchies and permissions tailored to your organization. With access to all necessary details in one view, buyers only need to click.

Master data management

With automated supplier records, you can reduce payment risks, ensure compliance, and minimize workload. Records, including credit scores and current tax registrations, are continuously updated from global company databases.

APIs and more

Integrate to your ERP with ease. Accounts payable automation solution with developer-friendly APIs and documentation, SFTP file transfer, and ready-made connectors for common systems.

Get in touch

Manage, automate, and visualize your sales and purchase transactions with Qvalia.

Exchange e-invoices, e-orders, and more with a full-suite solution — accessible via API or web app. Gain efficient Peppol access and multichannel EDI.

Our customers transform processes and achieve full control over transactional data at the line-item level. Contact us to see how we can optimize your purchasing and sales processes.

Create, send & receive electronic business documents efficiently

Create, send & receive electronic business documents efficiently

AI-powered data enrichment

AI-powered data enrichment

Digitize and streamline your processes

Digitize and streamline your processes

What is an accounts payable process?

The accounts payable (AP) process is the company’s workflow to manage its obligations to suppliers and vendors. It ensures that all incoming invoices are processed, verified, and paid accurately and on time.

A typical AP process includes several key steps:

1. Invoice reception: The company receives invoices from suppliers as electronic invoices, PDF invoices, or paper documents.

2. Invoice validation: The invoice is checked for accuracy, including details like the supplier’s name, invoice amount, due date, and payment terms. This step often involves matching the invoice to purchase orders and receiving reports (three-way matching).

3. Approval: Once validated, the invoice is routed for approval by the appropriate individuals or departments within the company.

4. Invoice posting: After approval, the invoice details are posted (recorded) to the correct accounts in the company’s ERP or accounting system. This means allocating the expense to the correct general ledger accounts, cost centers, or projects to ensure proper accounting.

5. Payment: Payments are issued to the supplier on or before the due date through electronic funds transfer (EFT), wire transfer, or check.

6. Accounting and reporting: After the payment is made, the transaction is recorded in the company’s accounting or ERP system. This ensures the company’s accounts are updated to reflect the cleared liability.

Efficient AP processes can reduce manual tasks, improve cash flow management, and strengthen supplier relationships. Automating these processes, such as through OCR and AI tools, can further enhance accuracy and efficiency.

How does accounts payable automation improve business efficiency?

Automating the accounts payable process reduces manual tasks, such as data entry and invoice matching, and speeds up invoice validation, approval, and payment. Automation tools, such as invoice OCR (Optical Character Recognition), AI-driven posting, and supplier record management, help to save time, eliminate errors, improve accuracy, and ensure timely payments.

Additionally, a more data-driven approach provides real-time insights into liabilities, improves cash flow management, and frees employees to focus on more strategic tasks. This streamlines the entire AP process, making it more efficient and cost-effective.

What is invoice posting, and how does it impact financial reporting?

Invoice posting is the accounting process step where an approved invoice is recorded in the company’s accounting or ERP system.

This involves allocating the invoice amounts to the correct general ledger accounts, cost centers, or projects, ensuring that expenses are correctly tracked.

Posting impacts financial reporting by ensuring that liabilities and expenses are accurately reflected in the company’s books. Correct posting ensures that financial statements like the balance sheet and income statement accurately represent the company’s financial position, a central part of compliance and decision-making.

How can businesses ensure accuracy and compliance in their accounts payable processes?

To ensure accuracy and compliance in accounts payable processes, businesses can implement the following strategies:

Automation: Use software tools to validate invoices, match them to purchase orders, and ensure correct data entry and posting. Automation reduces human error and speeds up processes.

Standardized workflows: Establish clear approval hierarchies to ensure that all invoices follow a consistent process from receipt to payment.

Compliance checks: Implement controls to check invoices against company policies, tax regulations, and legal requirements to avoid compliance issues.

Regular audits: Conduct periodic audits of AP processes to identify discrepancies and areas for improvement.

Supplier management: Ensure that supplier master data is accurate and up to date, reducing the likelihood of processing incorrect or fraudulent invoices.

How does the classification of products and services improve business processes?

Product and service classification can be integrated into business documents such as purchase orders, invoices, product catalogs, and databases to identify categories and simplify product identification. UNSPSC (United Nations Standard Products and Services Code) is the most widely used and usable global classification system with a hierarchical structure.

Classification can be integrated into business documents such as purchase orders, invoices, and product catalogs. By adopting this standard, your organization and stakeholders across the supply chain will benefit from streamlined procurement, finance, and business processes.

Classification simplifies invoice processing for accounts payable by categorizing line items for better accuracy, faster approvals, and improved reporting. This leads to more efficient workflows, reduced manual effort, and greater control over spending.

For procurement, classification helps track spending, conduct accurate spend analysis, and find products faster, improving supplier negotiations and driving savings.

In marketing, teams can use detailed product data for better market research and product development, which can lead to increased customer satisfaction and revenue.

Sales teams gain enhanced market insights, streamline sales analysis, and expand their reach through e-catalogs and global marketplaces.