Transactions, technologies and trends

Category: E-invoicing

E-invoicing, or electronic invoicing, is a digital method of generating, sending, receiving, and processing invoices between businesses and their trading partners. Unlike traditional paper-based invoicing, e-invoicing leverages technology to automate and optimize the entire invoicing process, leading to increased efficiency, accuracy, and cost savings.

Key features of e-invoicing include:

- Automated Generation: E-invoicing systems automatically generate invoices based on predefined templates and transaction data, reducing the need for manual input and minimizing errors.

- Instant Delivery: Invoices are transmitted electronically, enabling real-time delivery to recipients regardless of their location. This accelerates the billing cycle and supports prompt payment processing.

- Data Accuracy: E-invoices are created from structured data, reducing the risk of human errors that can occur during manual data entry. This accuracy leads to faster approval and payment cycles.

- Digital Signatures and Authentication: E-invoicing solutions often incorporate digital signatures and authentication mechanisms, enhancing security and authenticity of the invoices.

- Integration: E-invoicing systems can seamlessly integrate with accounting software, enterprise resource planning (ERP) systems, and other financial management tools. This streamlines data entry and ensures consistent records.

- Efficient Workflow: E-invoicing automates the approval and processing workflow, allowing for easier tracking and visibility into the status of invoices.

- Cost Savings: By eliminating paper, printing, postage, and manual processing, e-invoicing significantly reduces administrative costs associated with invoicing.

- Environmental Impact: E-invoicing contributes to environmental sustainability by reducing paper consumption and carbon footprint associated with traditional invoicing methods.

- Compliance: Many regions have introduced e-invoicing regulations to standardize electronic invoicing practices. E-invoicing solutions often help businesses stay compliant with these requirements.

- Analytics and Reporting: E-invoicing systems provide data insights and reporting capabilities, enabling businesses to analyze payment trends, optimize cash flow, and make informed financial decisions.

As businesses embrace digital transformation, e-invoicing plays a crucial role in modernizing financial processes. It not only improves operational efficiency but also enhances collaboration with partners, minimizes payment delays, and contributes to a more sustainable and connected business ecosystem.

Explore our articles about e-invoices and next-gen invoicing practices.

Most companies have already transitioned from paper to digital, but many are still stuck with fragmented tools, manual routines, insufficient tools built into ERPs, …

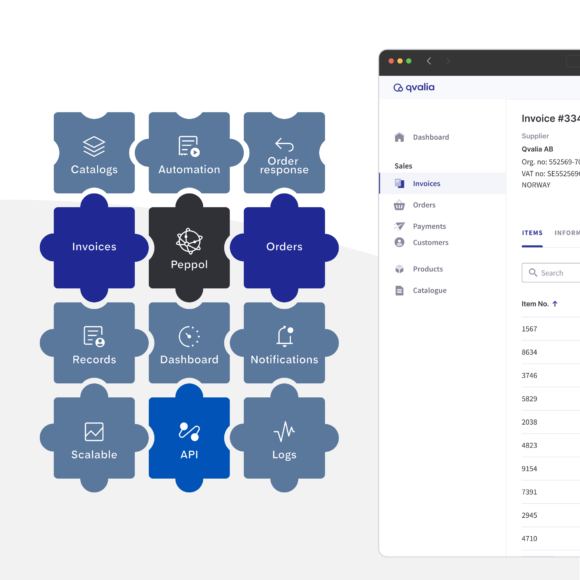

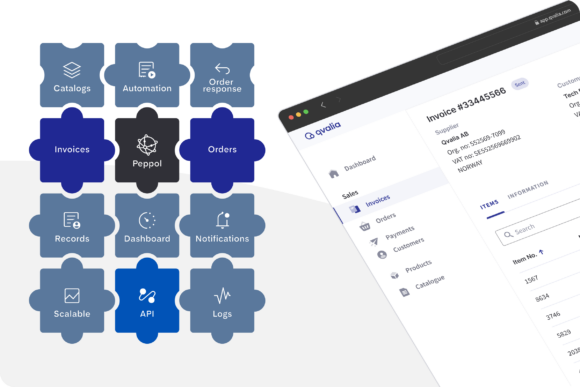

We’re launching Connect — the online tool and business messaging API to make electronic invoicing and order management easier, faster, and more cost-efficient for every business.

The adoption of e-invoicing and e-procurement is accelerating across public administration in Europe. A recent Swedish study offers insights among municipalities and central government agencies.

As regulatory frameworks for e-invoicing and digital reporting continue to develop, 2025 marks a new year of navigating compliance. Here are the new regulations.

Value-Added Network (VAN) solutions and legacy technologies used for business messaging — the exchange of electronic business documents — are increasingly being outpaced by alternatives that offer more seamless, accessible, and cost-efficient transaction management.