Qvalia blog

Category: Accounting

Accounting is the systematic process of recording, summarizing, analyzing, and interpreting financial transactions and information within an organization. It serves as the foundation for monitoring the financial health of a business, facilitating informed decision-making, and ensuring compliance with regulatory standards.

At its core, accounting involves the following key aspects:

- Recording Transactions: Accountants meticulously record all financial activities, including sales, purchases, expenses, and revenue, in an organized and standardized manner. These transactions are documented in financial statements, journals, and ledgers.

- Financial Statements: These documents, including the balance sheet, income statement, and cash flow statement, provide a snapshot of a company’s financial position, performance, and cash flow. They help stakeholders evaluate profitability, liquidity, and overall stability.

- Summarization and Classification: Accountants categorize transactions into different accounts, creating a clear structure that facilitates analysis. Common accounts include assets, liabilities, equity, revenue, and expenses.

- Double-Entry System: Accounting relies on the double-entry system, where each transaction affects at least two accounts with equal and opposite entries. This ensures that debits and credits are always balanced and accurate.

- Financial Analysis: Accountants interpret financial data to provide insights into a company’s financial health, trends, and performance. This analysis assists managers, investors, and stakeholders in making informed decisions.

- Auditing and Compliance: Auditors verify the accuracy of financial records, ensuring they adhere to established accounting standards and legal requirements. This process enhances transparency and instills confidence in financial reporting.

- Management Accounting: In addition to external financial reporting, accounting supports internal decision-making through management accounting. This involves generating reports, budgets, and forecasts to guide operational and strategic choices.

- Taxation: Accounting plays a critical role in calculating and reporting taxes accurately, minimizing the risk of non-compliance and optimizing tax strategies.

In today’s complex business landscape, accounting software and technology have revolutionized the field, automating routine tasks and enabling real-time access to financial data. This transformation enhances efficiency, accuracy, and the ability to respond swiftly to changing financial conditions.

Ultimately, accounting serves as a vital tool for organizations to maintain financial transparency, meet regulatory requirements, attract investors, and navigate the intricate financial landscape with confidence.

Read our blog articles to learn more about how accounting is changing in an increasingly digital world.

The raison d’ être of technology and digitized transactions is flawless finance processes. Does the technology live up to the promise and what is …

International Finance Awards has appointed Qvalia as Best Transaction Analytics Solution Provider in the Nordics 2019.

Capital leakage in finance processes is a curious but undeniable fact – and an anomaly in an increasingly potent digital world. A new report …

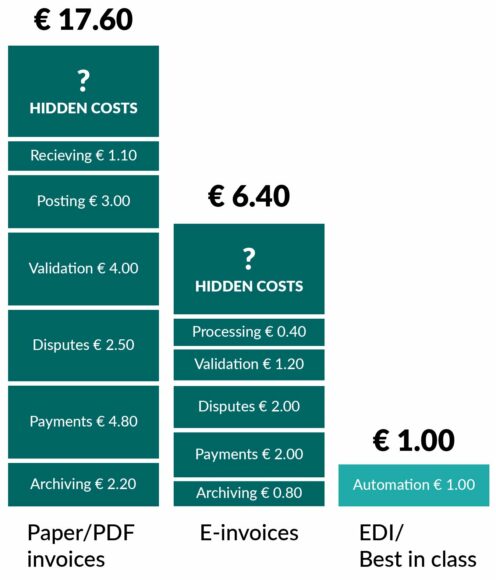

Outdated processes, legacy systems, and the human factor cause accounting errors – and capital leakage for companies and organizations. We’ve put a price tag …

For accounts payable teams, the airline industry is one of the most complex—a consequence of the large transaction volumes and highly international operations of …