Are you familiar with factoring and order financing? Factoring is the practice of buying up unpaid invoices at a discounted price so that the owner of the invoices gets paid faster. Order-based financing is similar but pushes the cash flow forward, to the event of receiving a purchase order.

Invoices often have long payment terms that cause issues with cash flow, causing companies that operating in B2B markets to consult with factoring companies. Once a factoring provider receives the invoice or order, that firm takes over the payment process.

Factoring and order financing make sense when you’re okay with a lower amount as long as you receive it in a shorter time frame. In other words, you are accelerating cash flow by accepting the money before your client has finished paying off the invoice.

So, for what types of companies are it the right choice? Read on to learn the basics of factoring, when you should consider it, and other key insights.

When would I need to use factoring?

Any instance where you have multiple outstanding invoices but not enough money in your pocket to handle all your expenses yet is a good use case for factoring. For example, you might require clients to finish payments within a month, but some of them might be late on those payments even though you originally planned on having that cash in hand by that date.

Invoice factoring gives you access to that cash almost immediately, and it can be useful for repaying a loan, covering short-term expenses, or taking advantage of seasonal demand. Compared to a bank loan, factoring is cheaper in the long run and easier to secure.

Average factoring costs are between 1% and 5% depending on the factors such as volume, average invoice sum, customers’ creditworthiness, and industry. Volume plays a huge part. Larger monthly amounts equal lower fees and it’s common with volume discounts.

When would I need to use order financing?

Order financing, or purchase order financing (PO financing), is similar to invoice factoring — a traditional service to get a cash advance for improved the cash flow based on purchase orders instead of invoices. It reduces strains that can occur when small businesses need to pay suppliers to fulfill orders.

Order financing fees normally range from 1% up to 5% per month and are usually priced on a per-30-day period. These fees are charged on the total of the supplier’s costs, but increase if the days outstanding for invoice payments are the longer.

What should I keep in mind if I decide on factoring and order financing?

Businesses that choose to use invoice factoring services must know a few potential drawbacks and considerations first.

- Take risk into account: Factoring mainly exists to spread out the risk involved with a few clients over your entire clientele. The consequence here is that it’s not recommended for firms with fewer customers or with a lot of high-risk clients. The service will consider the risk level of your customers when deciding on fees.

- Make it a major business decision: A factoring firm will often request to cover all of your invoices to take the load off your accounts receivable department. While a boon to your finance staff, doing so requires a degree of commitment from you and a long-term contract with the factoring company.

- You are outsourcing the customer experience to some extent: By handing over control of customer invoices to a factoring company, you are letting the factoring firm interact directly with your clients, forcing you to give up some control over the customer experience.

Consult with your accounting department to decide whether your cash flow woes are significant enough to warrant a factoring service. Despite some potential drawbacks, factoring is still a popular and beneficial way to solve cash flow problems conveniently.

Develop healthy cash flow habits with order-to-cash automation

Factoring is essentially a financial risk management strategy that aims to boost cash flow during uncertain times. Do keep in mind, however, that cash flow issues themselves can be solved early on by adopting the right accounts receivable practices and tools.

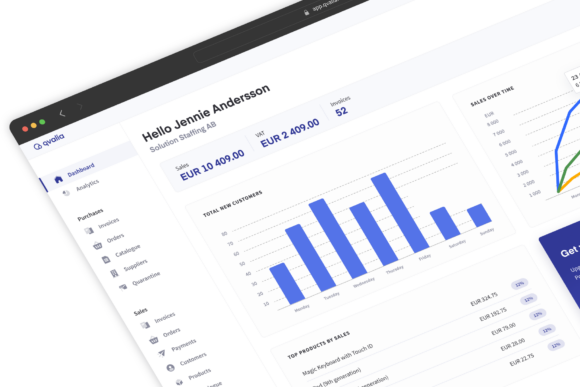

Is cash flow proving to be a recurring problem for your business? If so, consider adopting software solutions specific to order-to-cash and accounting. Qvalia can help you digitize and automate order-to-cash and purchase-to-pay, including invoices, master data, and more.

Are you looking to kickstart your financial automation journey? Book your Qvalia demo today to see how we can help you tackle the challenges.

Want to learn more about the order-to-cash process? Download our free guide.