Order-to-cash (O2C) is the complete cycle of a sold product’s journey through a business sales workflow. It includes steps like the original order to final delivery and all the receipts, invoices, and paperwork involved throughout this process. Let’s find out what the most common order-to-cash challenges are in this process.

To an organization, O2C requires the teamwork of multiple professionals working in finance, credit, collection, and accounting (to name a few).

Being able to process all those orders accurately, maintain compliance with regulations and industry standards, and do so promptly to avoid consumer frustration is a challenge.

However, the O2C process can be challenging for some companies. Read on to learn more about some of the biggest challenges companies face when implementing an effective O2C process.

What needs to be optimized in order-to-cash?

Order-to-cash is an umbrella term for multiple steps in the order fulfillment cycle. By focusing your attention on O2C, you aim to improve policies and procedures regarding the following steps.

- Delivering and fulfilling orders accurately and without delay. Should there be any errors in the shipment or changes in the order during processing, your business must be able to accommodate quickly enough. For example, goods might be returned or orders might be canceled early on.

- Payment must be monitored so that payment collection happens on schedule, no matter what payment method is selected. Part of this job is ensuring that the right invoices and approval documents get to the right people quickly.

- Compliance is another hot topic. Leave room in the budget to address regulatory requirements and auditing to prevent costly violations.

Order-to-cash is the foundation for your ability to sell products and services, and the image your clients have of you is ultimately a reflection of your accounts receivable team’s efficiency.

7 order-to-cash challenges

Let’s explore the most common order-to-cash challenges for finance and accounts receivable teams.

Inefficient payment methods #1

We’re talking about paperwork. From checks to cash, the traditional methods of payment are just too slow for modern-day operations, yet they still take up nearly half of all B2B transactions. Converting to digital is an inevitable change that will take some work to get going.

Manual work #2

Much of the invoicing done during order-to-cash involves plenty of menial data entry and physical paperwork. Businesses are struggling to balance these types of jobs with more important work that employees could otherwise be doing. Part of financial automation’s appeal lies in freeing up time in the day for other tasks like strategic planning.

Slow speed #3

A major consequence of the above two problems is a generally slower O2C process. If you cannot speed up this workflow, you run the risk of hitting delays or failing to capitalize on early payment discounts.

Overhead fees #4

A lot of payment methods require some type of added processing cost, which can add up, especially when you have recurring payments. You will have to factor those in when doing your financial planning.

Payment lead time #5

With large B2B transactions, the time it takes for an order to be made and the time for the money itself to show up in the other account can sometimes take a few days. How do you ensure your cash flow is set up in a way to allow that lead time?

Security concerns #6

Protecting the sensitive data shared during a transaction matter, as you don’t want to lose the trust of your customers, merchants, or business partners.

Lack of data analytics #7

Tracking the flow of money is important for maintaining visibility during your transactions and checking for potential errors, yet many businesses don’t have proper systems in place to do so.

How do successful businesses address most of the pain points regarding order-to-cash? They incorporate financial process automation into their overall digital transformations.

How to avoid order-to-cash challenges

Order-to-cash is the lifeblood of a firm’s ability to generate revenue from the sales of its products and services. Taking the time to improve O2C will result in more efficient internal operations and happier clients in the long-term.

What’s the answer to these impending challenges facing the business sector today? If you want to stay competitive, consider an automated solution that specializes in business payments and invoicing.

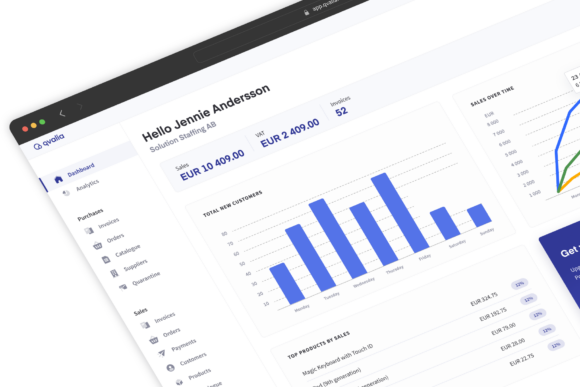

Order-to-cash automation solutions from Qvalia handles multiple accounts receivable tasks—such as B2B payments for e-commerce, invoicing (including Peppol BIS Billing 3 e-invoices), reconciliation, order management, and reporting. Combining all its features under a single platform gives you a holistic overview of controls for getting the most out of your order-to-cash process. Check out Qvalia’s solution by booking a demo with us today.