The OpenPeppol non-profit organization developed the Peppol network to standardize and simplify international procurement across borders; e-invoicing, e-ordering, and more

They achieved this by creating a network that is both flexible and accommodating as possible for the various business needs and transactional procedures of companies and governmental organizations within the EU.

At first glance, it might seem complex. But understanding how the underlying network functions through some easy-to-understand models is the first step to becoming an expert in how information is exchanged through the network. And not least, it’s much easier to use and significantly more cost-efficient than previous models of electronic business exchange maintained by traditional service operators.

While Peppol established itself using a four-corner model, it continues to evolve its network with new features and improvements. Let’s have a look at the different models for exchanging electronic business documents and what makes Peppol stand out.

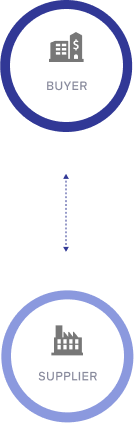

The two-corner model: early days of electronic business exchange

In the context of business procurement, the two-corner model is how information was distributed in the early days of EDI e-invoicing, a hard-coded exchange between two parties. This peer-to-peer process typically involves exchanging various EDI messages (electronic data interchange), for example, EDIFACT, custom formats, such as structured text, or XML-based (extensible markup language) messages, such as UBL.

There are several limitations to this setup. Both companies must set up their own communication systems to send and receive messages. Also, entirely new connections had to be set up whenever you talked with a new company for the first time.

While a solid start for early digital commerce with decades on its back, the demand for a more efficient and accessible system was clear.

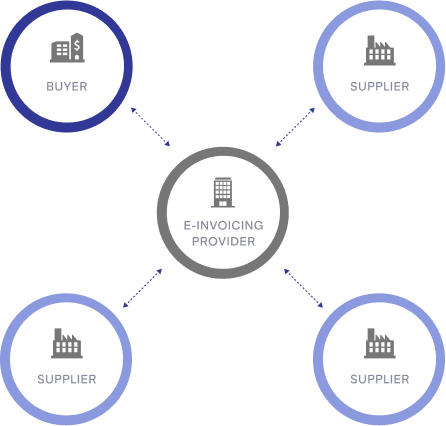

The three-corner model: connecting through service providers

In a three-corner model, the two communicating parties are connected by a middleman, typically a service provider.

This type of setup is more flexible as it outsources much of the infrastructure and the handling of the messages to a third-party. This service provider, also known as a VAN operator, may often add features like converting file formats to fit their customer’s ERP systems. There are also service providers that can manage analog formats such as PDFs by using optical character recognition for extracting and validating data into the proper format or cloud connectivity for digitization purposes and more efficient exchanges.

The major drawback, however, is that both the sender and recipient must be compatible with the same service provider, posing potential problems for larger networks.

The four-corner model: modern electronic transactions

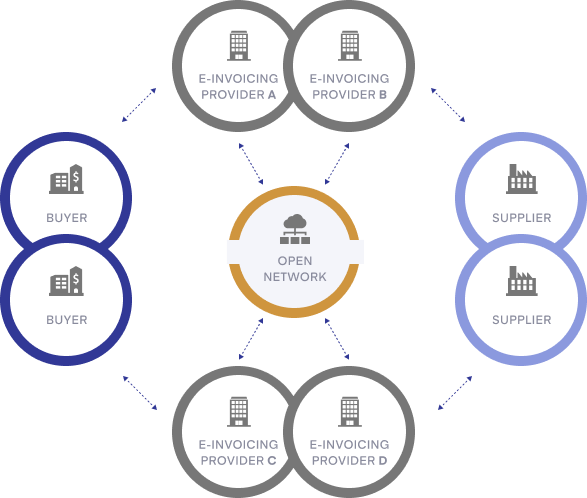

Peppol runs on the four-corner model, which can be summarized as four components working together to enable an information exchange for procurement data: a sender, a recipient, and two access points (one for each of them).

When a message is sent through a four-corner model, the following steps occur:

- The sender talks with its access point and creates a new message in the agreed-upon format of the network.

- The sending access point references the service metadata locator to find the Peppol ID of the recipient, which has been previously registered in the network.

- The sender’s access point pushes the message to the recipient’s access point, which then forwards the message to the intended recipient.

- The two access points connect once more to confirm that the message was sent successfully. A transport acknowledgment may be involved.

Compared to the three-corner model and traditional VAN e-invoicing solutions, the Peppol four-corner model used today in the Peppol network offers much broader flexibility.

Because Peppol controls the access points, there is no need for both companies to sign up with the same service provider. Additionally, these service providers don’t need to perform a specific setup or agreement to exchange messages. In fact, the sender doesn’t even need to be registered in Peppol and have its own Peppol ID; all that’s needed is the recipient’s ID to exchange e-invoices and other procurement information.

Get access to Peppol

Peppol changing the way companies do business transactions. More secure and efficient transaction management with Peppol is only a few clicks away when you work with a Peppol access point provider like Qvalia. Discover how we can accelerate key finance processes within your organization through streamlined Peppol access and finance automation. Book a demo today to get started.

The five-corner model: a look into the future

The OpenPeppol organization is working on new developments to improve how we handle B2B commerce.

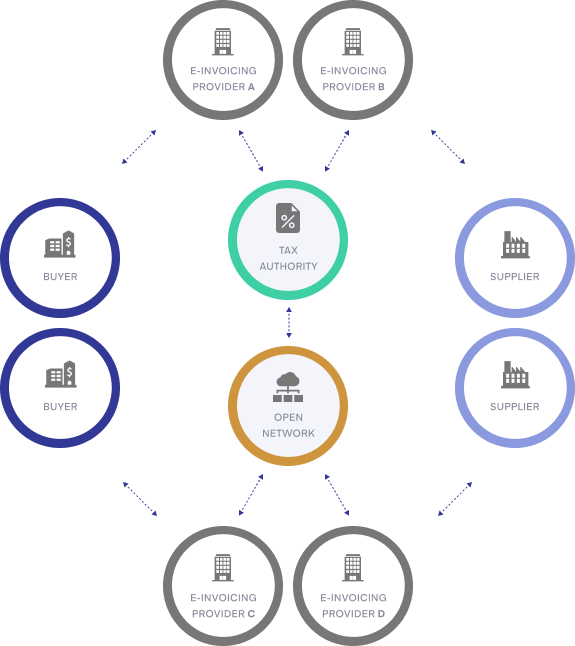

Besides continuous efforts to onboard new national Peppol authorities, a new five-corner model is being developed that adds a central tax platform to the infrastructure.

Governments see Peppol as an opportunity to take control of tax liabilities during international and domestic commerce, address the pressing VAT gap issue, and make reporting more efficient. By adding this fifth corner to the network, Peppol users can — or must — communicate with tax authorities and include VAT charges in the e-invoicing process more seamlessly. The result is a stronger legal compliance posture for everybody involved.

The technologies that enable the Peppol network

In addition to the “corners” model, Peppol works with a variety of interoperable document formats and models that allow it to work in multiple nations across Europe and Asia.

Standardized e-invoicing

The European Union works with its own e-invoicing standard codenamed EN 16931. This systematic approach to invoicing supports multiple EU laws and directives, such as the Principle VAT Directive for tax purposes.

The specific implementation of this standard is the Peppol BIS Billing 3.0 format, which any European public authority has an obligation of following by law.

While other countries, such as those in the Asia-Pacific region, aren’t necessarily compatible with EU Directives, Peppol BIS Billing 3.0 was extended there as well through PINT, as explained in the next section.

The PINT model

PINT is a shorthand version of the Peppol international document model designed to make invoicing consistent across the European and Asia-Pacific regions.

The vast majority of PINT invoices have shared specifications to provide global interoperability, but unique jurisdictions are still allowed to add their own rules that wouldn’t necessarily apply to the general network.

Continuous transaction controls

One consideration that governments have asked for is the integration of tax authorities into Peppol. Continuous Transaction Controls (CTCs) were designed to digitize and implement tax collection into the network. This way, VAT and GST are properly kept track of, and tax fraud and evasion are far less likely to occur.

Peppol achieves CTC by enabling real-time data collection about cross-border transactions to facilitate the management of indirect taxes. In fact, the concept of the five-corner model relies on having an extra corner in the form of a tax authority and possibly even a service provider that serves it.