If you don’t know where your money is going, you run the risk of losing your budget to maverick spending, misallocated resources, efficiency bottlenecks, and other unnecessary losses. Accounts payable (AP) departments are designed to manage and keep track of short-term liabilities, money that the company owes its suppliers, accounts receivable, or even its customers.

Given the highly metrics-driven and quantifiable nature of AP, its operations can be the key to keeping organizational spending efficient level while ensuring that you can make informed business decisions about future financial activities.

Data analytics can be essential for the AP process to help your entire organization make better decisions. Here’s what a data-driven AP team can help you accomplish:

Easier planning

AP management uses relevant metrics to help schedule tasks for the department and allocate resources to where they are needed most. For instance, if you notice a large number of invoices filed in January, you can plan to get more staff members on board that time next year to help handle all the AP workload.

Planning can also extend to reducing bottlenecks in the process. Bottlenecks occur when the number of invoices your teams can process is greatly exceeded by the number you are receiving. AP managers finding themselves in this situation should use AP metrics to determine how to fix the problem. If manual data entry is the culprit, consider adopting automation solutions designed for accounts payable teams.

Improving cash flow

Occasional errors in the financial department are unavoidable, especially if you rely on human input for most of the work. Missed payments, duplicate transactions, and wrong amounts occasionally happen, and tracking these mistakes through data metrics will give you insight into where you can improve the cash flow and financial health of the company.

Identify avoidable costs

AP teams have a chance to focus on efficiency when working with data and metrics. Processing delays can lead to late penalties or force you to miss out on early payment discounts.

Take a deep dive into finding out how much it costs to process a single invoice. How much are you paying personnel to do manual tasks that could potentially be automated? Are the software and tools you’re paying for doing the job? A holistic approach will tell you what specific steps might need optimization.

Handling payments

You work with a wide variety of partners and businesses, so it’s easy to assume that there will be a wide variety of payment types to work with. AP teams usually struggle to handle multiple methods like:

- Checks

- Virtual cards

- Electronic transfers

Each of these options typically requires its own specific system for processing, and the result is a larger investment into getting them done on time.

Track which payment methods are common in your organization. Any room for consolidation? Are you utilizing your integration capabilities to banks, AP software or other services or solutions?

Better business relationships

Making payments to your business partners on time is an excellent way to boost your professional relationships. A fast, easy transaction implies a level of trust with your company, which is why some businesses offer discounts for good payment habits.

One of the key performance indicators to track is how many early payment discounts you’ve managed to achieve out of all the ones offered to you. Maximizing this figure shows that your business has a healthy cash flow and can be trusted for future transactions.

A related metric is how well your business handles the invoices sent to you. Some partners may choose to send electronic rather than paper invoices, so make sure your teams are able to handle the different types. Processing delays are only frustration for both sides, and they can be prevented through AP automation.

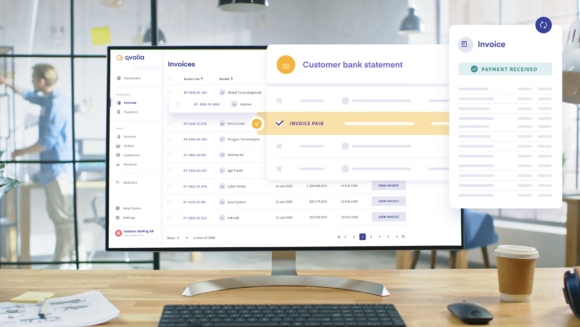

The place of automation for the AP department

You’ve probably noticed that we’ve mentioned automation quite a few times so far. For departments like finance that require a lot of data entry, information processing, and analytics, there’s a large risk for human error and inefficiencies due to manual labor.

As a CFO, it might be time to consider new solutions for financial management. Bring yourself in line with the competition by supporting increased digitization with e-invoices, and e-orders, as well as automated processes, removing bottlenecks and repetitive daily tasks like invoice validation and master data management, and much more. Get the ebook Automation for CFOs.