There is no “one size fits all” approach to analyzing procurement spend. What your organization purchases from suppliers is different from that of another, and how you go about vendor agreements differs as well. Here are the different types of spend analysis.

Businesses of different sizes and industries, in general, need a specialized, tailored way to conduct spend analysis.

While the benefits and general process of spend analysis remain constant everywhere, let’s talk about some of the types of systems in use today.

The distinction between direct and indirect spending

When it comes to business spend, most people think of factories purchasing the raw materials needed to manufacture products. However, this direct spending does not cover all needs most of the time. Some purchases are made to handle the internal operations of a business. This indirect spending might include consulting services, marketing, maintenance, IT services, utilities, and human resources among others.

Why does this distinction matter? Here are the ways we look at direct and indirect spending differently:

- Procurement teams expect to spend a decent amount on direct purchases: They estimate how much certain raw materials should cost and negotiate with contractors accordingly. Indirect spending, by contrast, often involves a zero-based budget where the team tries to save as much as possible. Managers must justify every expense before adding it to the invoice.

- Direct spending, by nature, is required at all times to continue producing products and services to sell: The need for indirect spending is entirely dictated by demand. The business orders consulting services, for instance, only when it needs them.

- A central authority, usually a supply chain team, handles direct expenses: Indirect costs come up based on need, so they are often the responsibility of independent stakeholders throughout the business.

Approaching spend analysis goes beyond just direct and indirect expenses. Account for how you’re going to be looking at the financial data.

Methodologies for categorizing and analyzing spend data

Depending on your specific industry and needs, there are many things you can do with the information you gather. Whether you’re looking at expenditures by category, item, contract, supplier, or otherwise, these are some starting points to consider. These are the most common types of spend analysis.

Category spend analysis

Why do analysts classify the purchases first before initiating analysis? Taking the time to understand what exactly you’re paying for goes a long way to knowing how money flows through the company.

For instance, how much does a certain category take up in the budget every quarter? Is it possible that multiple departments are buying similar products that could possibly perform the same task?

Categories, in general, are heavily recommended for this reason: prioritizing the budget and giving you insights into the “why” of your spending.

Item or contract spend analysis

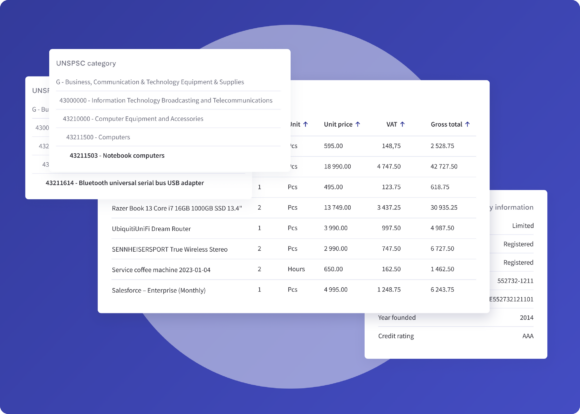

Another option is to look at expenditures by specific item or SKU. Identify who bought the item and which supplier is responsible for the order. Similarly, you can organize based on contracts made with suppliers to ensure compliance with the terms and renegotiate better deals.

Another similar strategy is to look at payment terms when doing spend analysis. Find ways to pay invoices early, as some vendors offer discounts for doing so. Just remember that paying everything too early might cut down on your working capital.

Supplier profile spend analysis

Also consider creating individual profiles for each supplier you use. Record past transactions and line items with each vendor and decide on future spending decisions based on the data. You might be able to negotiate better deals, identify deviations from framework agreements, and improve relationships with suppliers effectively this way.

Tail spend analysis

Most spend analysis processes will only cover the majority of the business’s financial activity. A small portion of spending typically covers all the small or infrequent purchases made by employees that most records fail to account for. This “tail spend” doesn’t get much attention and is therefore inefficient and uncontrolled.

Download the free ebook “A guide to spend analysis: How to enable data-driven decision-making in procurement” and learn more about how spend analysis can be used in your organization.

Getting spend analysis software

Spend analysis may seem complicated from the outside, but the fundamentals can make a significant difference in your company’s financial processes.

With Spend Monitor, Qvalia’s seamlessly integrated spend analysis feature, you’ll extract more value out of your financial data from the get-go.